- First-time winners - MFS Africa, TeamApt, and Paga, were recognised for building payment networks in Africa.

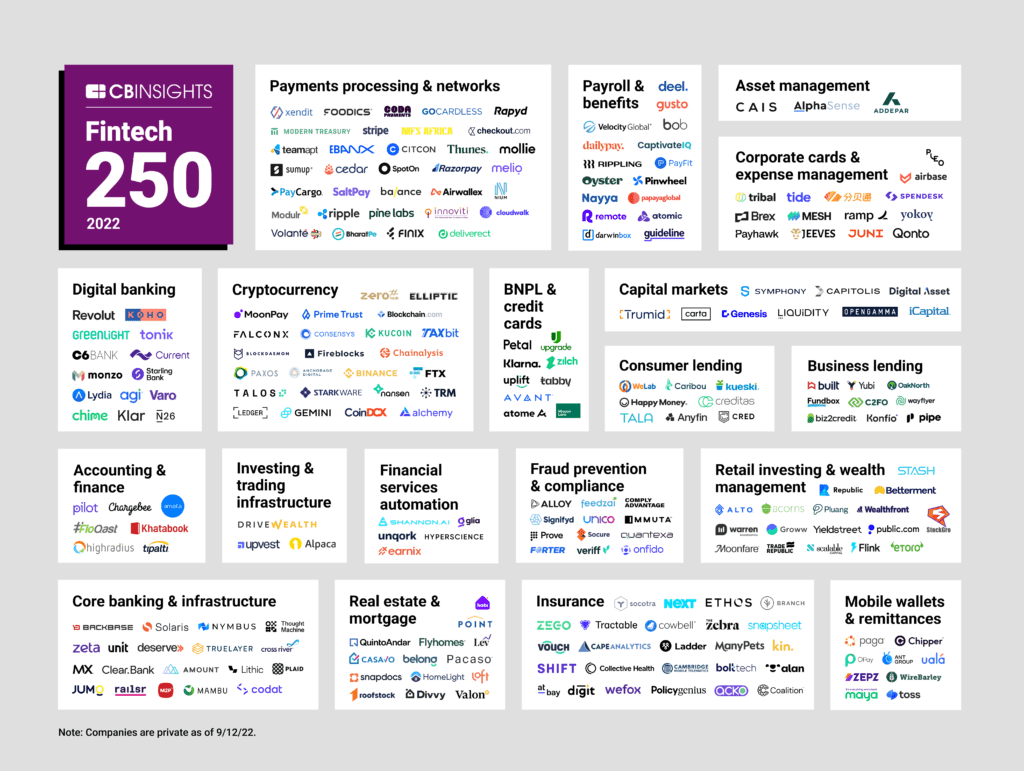

- This year’s winners are shaping the future of B2B and B2C financial services, from payments and banking to investing and insurance.

- For more African business stories, visit africa.businessinsider.com/

CB Insights has unveiled the winners of the fifth annual Fintech 250 — a list of the 250 most promising private fintech companies worldwide. Among the 2022’s cohort are six companies headquartered in African countries.

Some of this year’s winners are building safer and more efficient ways to send and receive payments. Others are striving to make banking, loans, mobile wallets, and investing products available to historically underserved populations all over the world.

According to CB Insights, this year’s winners were chosen based on factors including proprietary Mosaic scores, funding, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty.

The report also noted that factors such as rising inflation, interest rate hikes, and struggling public tech stocks have made it more difficult for new entrants to make a splash in the already maturing fintech market.

Top Investors: Tiger Global is the top investor in this year’s Fintech 250 by a significant margin, having backed equity deals to 45 of the winners, including Stripe, Checkout.com, Revolut, and FTX, since 2017. Accel is second with 29 companies in its portfolio, followed by Ribbit Capital with 27.

READ ALSO: African startups raised over $3 billion in funding in H1 2022

Here are the 6 most promising African fintech companies of 2022, according to CB Insights Fintech 250 list

1. JUMO (South Africa)

Total funding: $267 million

Disclosed Investors: Google for Startups Accelerator, Finnish Fund for Industrial Cooperation, GEMCORP, Mastercard Foundation, Proparco, Goldman Sachs, LeapFrog Investments, VEF, Odey Asset Management, Ash Park, Fidelity Investments, Visa Ventures

2. KuCoin (Seychelles)

Total funding: $180 million

Disclosed Investors: IDG Capital, Matrix Partners China, NGC Ventures, Circle Ventures, Jump Crypto, Susquehanna International Group

3. MFS Africa (South Africa)

Total funding: $281million

Disclosed Investors: Goodwell Investments, LUN Partners Capital, Equator Capital Partners, FSD Africa, UK Department for International Development, Lendable, Norsad Finance, AfricInvest, Allan Gray, British International Investment, CommerzVentures, Endeavor, Endeavor, AXA Investment Managers, Admaius Capital Partners, Vitruvian Partners

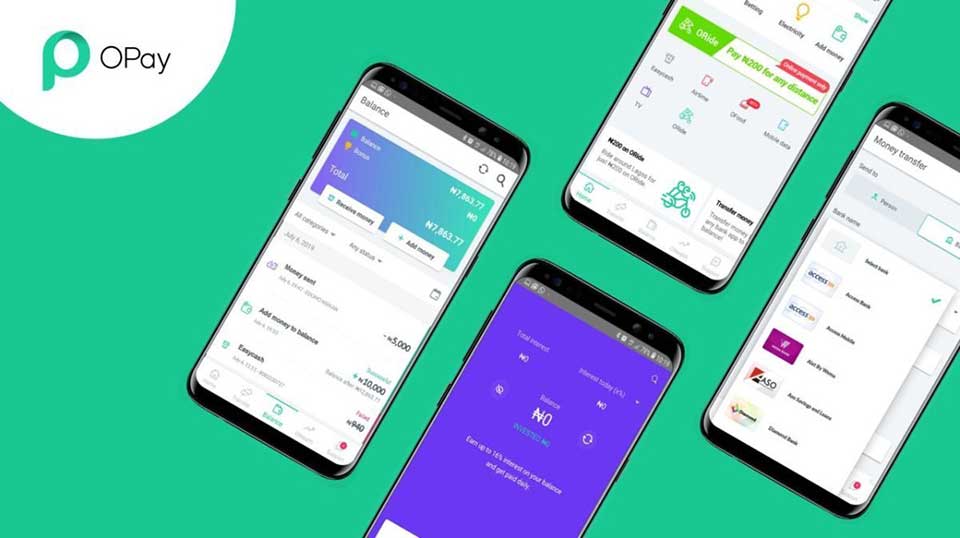

4. Opay (Nigeria)

Total funding: $570 million

Disclosed Investors: GSR Ventures, IDG Capital, Meituan Dianping, Opera, Sequoia Capital China, Source Code Capital, Bertelsmann Asia Investments, Gaorong Capital, Longzhu Capital, Redpoint Ventures China, Softbank Ventures Asia, 3W Partners, SoftBank Group

5. Paga (Nigeria)

Total funding: $38 million

Disclosed Investors: Acumen, Adlevo Capital, Capricorn Investment Group, Flourish Ventures, Goodwell Investments, Jeremy Stoppelman, Jim O'Neill, Tim Draper, Global Innovation Fund, Unreasonable Capital, Ping An Cloud Accelerator, Gaingels

6. TeamApt (Nigeria)

Total funding: $58 million

Disclosed Investors: Quantum Capital Partners, British International Investment, Endeavor, FMO, Global Ventures, Kepple Africa Ventures, Novastar Ventures, Oui Capital, Soma Capital, Lightrock, QED Investors.

--

READ ALSO: 7 African entrepreneurs who are changing the business landscape

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS