Debt-to-GPD ratio projected to reduce to 65% in 2024

Ghana piled up GH¢50 billion of debt from 2020, Bank of Ghana

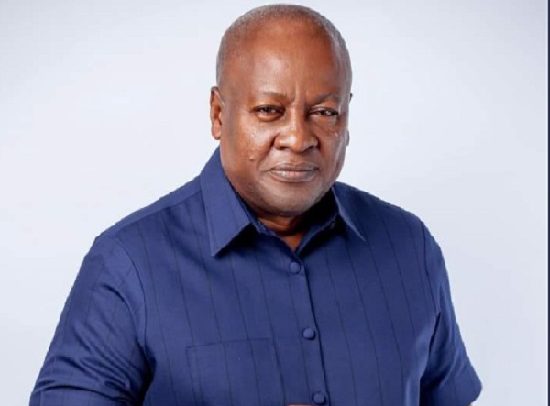

Director of the Institute of Statistical, Social and Economic Research (ISSER) at the University of Ghana, Professor Peter Quartey has urged government to be measured when it comes to borrowing in the 2022 fiscal year.

According to him, though government cannot entirely shy away from borrowing in the period, it must ensure that it remains keen on its debt management strategy to prevent more debt accumulation.

In an interaction with Citi Business News, the ISSER Director explained the move will also reduce the country’s debt-to-GDP ratio in the medium to long term.

“Government will certainly have to borrow. How much they borrow will depend on how much revenue they are able to raise. I however don’t expect that at our current debt-to-GDP ratio which is very high, the government would borrow like it used to in the past. It certainly has to be circumspect,” he pointed.

“If it wants to borrow, then it will have to factor that into where we are and where we plan to get to. Last year’s budget saw some projections that were trying to get the debt-to-GDP ratio down to 65% by 2024. I hope and believe that government will follow that trajectory to enable the country to get to a sustainable debt threshold in the medium to long-term,” Prof. Quartey added.

Already, figures released by the Bank of Ghana show that the country’s public debt stock as of September 2021 reached GH¢341.8 billion which is equivalent to 77.8 percent of Ghana’s Gross Domestic Product (GDP).

On the domestic debt front, Ghana’s accumulated GH¢178.1 billion while that of the external debt reached GH¢163.7 billion.

Meanwhile, in the first nine months of 2021, the Bank of Ghana said the country added GH¢50 billion of debt which was carried from 2020. Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS