Introduction

Minister of State,

Deputy Ministers and Directors,

Members of the reconstituted Board of the Securities and Exchange Commission (SEC)

Friends from the Media,

Ladies and Gentlemen:

1. Good morning. I gladly welcome you to the Ministry of Finance for the inauguration of the Board of the Securities Exchange Commision (SEC).

2. Four years ago when I inaugurated the SEC Board, I acknowledged the impressive growth in Ghana’s capital market from the early 1990s when we collectively laid the foundations of the capital market.

3. I also noted the many challenges facing the industry including weak institutions with inadequate capital, especially in the asset management business, slow pace of listings on the GSE, below par corporate governance practices and the fragile capacity of SEC to regulate the securities industry effectively given its human capital, technology and financial constraints.

4. I commissioned the Board with the mandate to deliver a strong SEC that is visible and effective, and emphasized the need to have dynamic and vibrant firms in the industry that understand the securities market and have the right products and services.

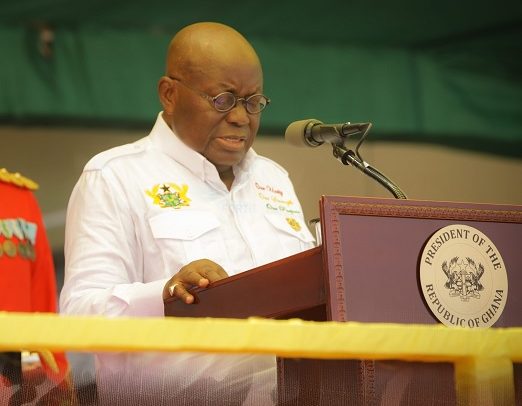

5. Four years on, I wish to acknowledge some good progress chalked in the securities industry with the support of the Ministry of Finance under the leadership of His Excellency, Nana Addo Dankwa Akuffo-Addo.

6. The market capitalization of the GSE has climbed up to GHS62.6 billion on the main board with all time high trading volumes being recorded in the GFIM in 2020 (GHS108 bn; HY 2021 GHS107 bn). There has also been a rebound of the performance of the market index to 41% (40% in US dollars) year-to-date (best performance on the African continent and one of the best in the world).

7. The biggest IPO in the history of the GSE was also achieved in 2019 with the listing of MTN on our market.

8. A collaboration between the London Stock Exchange and the GSE has been initiated to, among other things, help Ghana move from being classified as a frontier market to an emerging market.

9. The Ghana Commodities Exchange was also launched in 2018 with the potential of transforming the productivity of the agricultural sector with the facility of an organized trading platform and financing options through the Warehouse Receipts System.

10. The asset management industry has gone through a clean-up exercise with the revocation of the licences of 50 failed fund management companies resulting in the roll-out of Government bailout that is expected to cost an estimated GHS8.5 billion to affected investors whose funds were locked up. This social intervention has helped to restore and rebuild investor confidence in the industry. It is gratifying to note that assets under management has increased from GHS30.4 billion at the end of 2020 to GHS34 billion as at HY 2021.

11. Two months ago Ghana was removed from the Financial Action Task Force (FATF) grey list as testament to the significant reforms that Government has implemented in that space. I wish to acknowledge the contribution of the SEC in this achievement. The securities industry had been cited as the weak link at the time of the grey listing.

12. The SEC has also issued a raft of Guidelines to strengthen regulation and also foster the environment for market development including:

• Conduct of Business Guidelines (containing corporate governance principles for market operators)

• Licencing Requirements Guidelines (raising the minimum capital requirement and introducing more stringent requirements)

• Corporate Governance Code for Listed Companies

• Regulatory Sandbox Guidelines (for innovative products where there are no existing regulations)

• Private Fund Guidelines (for the operation of private equity and venture capital)

• REITS Guidelines (for the development of REITS in Ghana)

• Investment Guidelines (to guide the investment activities of fund managers)

13. The SEC has also launched a digitization program to inject greater efficiency and effectiveness in its oversight of the market and is also on course to migrate from a compliance based regulatory framework to a risk-based regulatory framework.

14. Finally, I also note the launch of the Capital Market Master Plan in May this year which provides the blueprint for the development of the capital market in Ghana anchored on four critical pillars:

• Improving diversity of investment products and liquidity of securities markets (to enhance investor participation and improve market liquidity),

• Increasing the investor base and promoting innovation and product diversification,

• Strengthening infrastructure and improving market services (to improve market integrity and accessibility), and

• Strengthening regulation, enforcement, and market confidence

15. We are alive at a turning point in human history. The global coronavirus pandemic has had a life-changing impact on all of us since it was first discovered in December 2019. Beyond its economic consequences, we have witnessed significant social disruption and hardship on a scale previously unforeseen in our lifetimes.

16. The visionary and bold leadership of His Excellency, President Nana Addo Dankwa Akuffo-Addo in these trying times steered the ship of state away from turbulence and ensured that we avoided a human disaster. We have not been spared of the global economic consequences though as we recorded the lowest GDP growth in recent times.

17. I am happy to say that our economy is already showing signs of recovery. Indeed, our economic indices reflect this state of affairs as inflation remains within the medium-term target of 8%±2%, while the cedi depreciation has been largely muted over the last twelve (12) months (depreciation rate of ~2.1% in the last 12 months). It is not surprising that the effective management of the country by our President has won international recognition leading to the European Union considering Ghana as a hub for the production of vaccines for the COVID-19 pandemic in the sub-region.

18. Under the leadership of His Excellency the President, we have launched the Ghana Cares/Obatanpa Program, a GHS100 billion three-and-a-half-year program designed to stabilize the economy as well as trigger a revitalization and transformation.

19. The GhanaCARES Programme has two main goals. The first goal is to turbocharge productive sectors of the economy via competitive import substitution, export promotion, economic diversification, and leveraging of digitization. Success on this goal will further improve food security, accelerate industrialization, create jobs, strengthen our foreign exchange reserves, and stabilize the exchange rate.

20. A second goal is to optimize the implementation of Government’s current growth and transformation flagships – such as the One District, One Factory, Planting for Food & Jobs, etc. – for greater results, value-for-money, and financial sustainability.

21. The Government recognises the critical role that long term (patient) capital plays in injecting life into the productive sectors of Ghana’s economy. It is in this vein that the Development Bank Ghana (DBG) is going to be launched to serve as a key pillar in our efforts to quickly recover from the effects of the COVID-19 pandemic and rapidly set our economic transformation path as articulated in the Ghana CARES/Obatanpa Program. We expect the DBG to complement the potential of the securities industry to provide patient capital to give expression to the entrepreneurial spirit of the Ghanaian, especially our talented youth.

22. I wish to remind you of the overarching theme of the 3-Cs as contained in my recent Budget presentation to Parliament: Completion, Consolidation and Continuity. You need to take stock and apply the needed effort and focus to ensure completion, consolidation and continuity.

23. I am aware that some work has already started on a number of initiatives including,

• The creation of a National Financial Data Hub

• The International Financial Services Centre

• An Investor Protection Fund

• Achieving a Signatory A status under IOSCO

• Implementation of the Capital Market Master Plan (I expect massive effort and commitment towards executing the initiatives).

It is imperative for the Board to ensure that these initiatives are continued to the point of completion.

24. The role of the capital market as a critical lever for economic transformation cannot be overemphasised and there is no better time than now for us to challenge ourselves to take the SEC and the industry to next level.

The Ministry, will from the policy side continue to:

25. Strengthen the capital market and its institutions to enable them serve credit institutions and businesses with access to long term capital.

26. Support the SEC to overhaul its regulatory framework and enhance its enforcement powers.

27. We will continue to work with the SEC to address its financial challenges in a way that will not negatively affect the growth of the market. We will support the quest of the SEC to get a befitting office space for its operations.

28. We will also work with the SEC to create a conducive environment for mortgage, housing and REIT development working with other financial sector regulators, including the development of home ownership scheme and an annuity market.

29. I will urge the Board to work with the management of the SEC to play leading roles in all financial sector engagements and work with the Ministry in achieving success as quickly as possible on many of these reforms.

30. Finally, I am confident of the quality of your membership, your varying degrees of expertise leaves me with no doubt that your Board will live up to expectation. Team work will ensure that the Board meets the expectations of Government, the Industry and the General Public.

31. Let me end by congratulating and declaring, the reconstituted Board of the Securities and Exchange Commission (SEC) duly inaugurated. Congratulations, and God bless our country.

32. Thank you, and God Bless You. Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS