Dr Mohammed Amin Adam

In a significant move towards debt restructuring, the Ghanaian government has launched an offer to restructure $13 billion of its international bonds.

The move comes more than two months after the government reached a preliminary agreement with two bondholder groups.

The offer, which was published in a regulatory statement on the London Stock Exchange, invites holders of the bonds to swap their holdings for new instruments.

Bondholders have until September 30 to accept the offer, but those who agree to do so before September 20 will be eligible for a 1% consent fee.

This development is a major milestone in Ghana’s debt restructuring efforts, which have been ongoing since the country defaulted on most of its $30 billion of international debt in 2022.

The default was triggered by a combination of factors, including the COVID-19 pandemic, the war in Ukraine, and higher global interest rates.

Ghana’s debt restructuring is being carried out under the G20 Common Framework, which has also been used by Zambia and Chad.

The framework has been criticized for being slow and cumbersome, but Ghana’s progress is seen as a positive step towards resolving its debt crisis.

The bond restructuring offer has been supported by a committee of Ghana’s international bondholders, as well as a regional group representing holders of over 25% of the bonds.

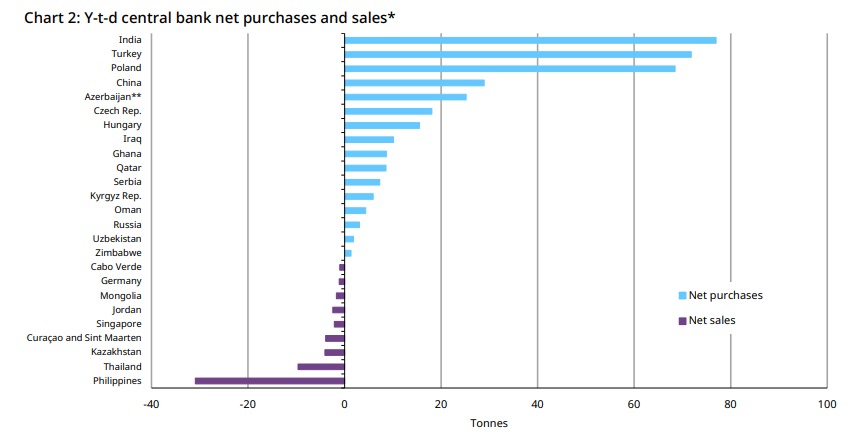

The offer provides bondholders with two options: a “disco” bond with an interest rate of 5% climbing to 6% after mid-2028, and a par bond option capped at $1.6 billion with a coupon of 1.5% and a maturity of 2037.

The agreement will see Ghana’s bondholders forego about $4.7 billion of their loans and provide cash flow relief of about $4.4 billion up until 2026, when the country’s current International Monetary Fund program ends.

Godfred Bokpin, an economist and finance professor at the University of Ghana, described the announcement as an important milestone in Ghana’s restructuring efforts.

“With this, investors now have a fair understanding of their losses and they can move on,” he told Reuters.

The new bonds will be issued on October 9, and holders of the Ghana 2030 international bond that was partially guaranteed by the World Bank will receive their guarantee payment on the same day or as soon as possible thereafter.

Overall, Ghana’s debt restructuring offer is a significant step towards resolving its debt crisis and restoring economic stability.

The move is expected to provide relief to bondholders and help the country regain access to international financial markets.

BY Daniel Bampoe

The post Ghana Outddors Debt Restructuring With $13bn Bond Offer appeared first on DailyGuide Network.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS