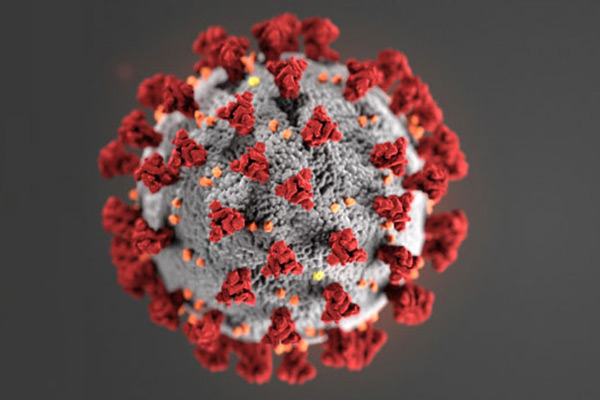

There is no sector in the world that is not being affected by the COVID-19 outbreak. Volatility has always been a challenging part of the oil and gas market but never has it been more intense than it is today. COVID 19-led demand shocks combined with its dramatic impact on the financial markets contributed to rapid price fluctuations. In reaction to the pandemic, our working lives have also changed dramatically, forcing us to find new ways of communicating while we consider the health of our colleagues and family.

Which course lies ahead in the coming months and years for the industry?

A few insights (and some questions) need to be put out to help oil and gas companies manage the current landscape.

Operational Challenges

Oil and gas operations are usually considered by governments to be necessary operations and were largely exempted from the lockout steps. Nevertheless, maintaining operations are likely to become more difficult due to shortages in the workforce as workers are likely to be diagnosed with coronavirus and the practical difficulties in many social distance situations. Therefore, companies should be prepared to operate skeleton teams in order to maintain operations, with delays for servicing, inspection, repair and replacement of equipment and drilling activities planned.

Operators would also need to consider third-party contractors operating on-site and the compatibility of COVID-19 policies; and the possibility of sealing off wells due to the reduced number of workers on drilling rigs dropping below the level mandated by health and safety legislation and the fair and prudent operator norm.

Credit Restructuring

We foresee a renewed emphasis on credit risk linked to counterparties as financial stress flows through the market. This implies that an extension of payment terms and novel funding mechanisms, which exploit stronger balance sheets and help retain weak counterparties while at the same time reducing the risk of investors (e.g. through share and/or asset security), may become popular again.

Mergers, Acquisition and Takeover Policy

Given the pace, size and uncertainty of the crisis, gaging buy-side interest is premature. Governments have tightened their regulation of foreign investment laws in many countries to protect vulnerable domestic firms laid low by the crisis. Those new laws would need to be navigated by international acquirers.

In the same way, acquirers will consider that any government help obtained by the target comes with conditions that hinder any restructuring and integration planned after the merger. As always, it will be necessary to consider the current debt package and to anticipate/negotiate the lender reaction to a new (solvent) borrower, and bear in mind the absence of contract security under the purchase agreement. Finally, despite the practical difficulties of due diligence in the months ahead, we are wondering whether any buyers would prefer assets they already recognize and, in any country, they find to be at lower risk of the any “second COVID-19 wave”.

Financing/ Refinancing Issues

The decline in the oil price would bring many upstream producers into default at the next borrowing base redetermination under their borrowing base facilities. Producers may be protected from the possibility of default payment as long as any hedges in commodity prices stay in place and are in the money.

Lenders would have to determine whether either to cancel the default (usually as part of a “amend and extend” debt restructuring); or enforce their protection rights.

Government Interventions

As energy supply is widely considered a matter of national importance, initiatives are gradually being introduced at the national level to provide some relief from COVID-19’s detrimental effects to the local oil and gas industry.

The COVID-19 pandemic is smashing long-held assumptions about the global economic and political system, with a clear shift towards direct involvement of government in national economies and an increased risk of global nationalization. No government will want to hand over critical economic sectors to a private operator especially during this COVID-19 pandemic moment.

The Force Majure Clause

As the situation deteriorates, many industry participants are reaching for the force majeure (FM) provisions in their key contracts to excuse failure to perform or to exit. Whilst these are typically designed to cover a situation where contractual performance is impossible, difficult or onerous to perform as a result of exceptional events outside either party’s control (for example a global pandemic), relying on a FM clause is very heavily dependent on the factual circumstances and the drafting of the specific clause. The choice of the contract’s governing law will also influence the availability of FM and similar reliefs including possible change of law relief.

Depending on the case, there are also likely to be some steps that a party attempting to claim FM will take to improve its chances of success, such as: defining particular measures (as opposed to coronavirus in general) and demonstrating the actual effect of such measures on it; mitigating the effect of these measures; and providing the contractually needed notices on time.

When volatility and confusion increase, the number and types of conflicts will increase due to organizations being unable (or unwilling) to fulfil existing contractual obligations.

How soon the pandemic will end, coupled with effective risk management practices among others will restore the oil and gas industry to a ‘reasonable’ state..

The writer, Sheldon Ambaah (Petroleum Economist) [email protected]

The post Sheldon Ambaah writes: How COVID-19 is affecting oil and gas industry appeared first on Citinewsroom - Comprehensive News in Ghana, Current Affairs, Business News , Headlines, Ghana Sports, Entertainment, Politics, Articles, Opinions, Viral Content.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS