Economists are highly expectant of a reduction in the policy rate by the Monetary Policy Committee (MPC) of the Bank of Ghana as the Committee prepares to announce its new rate next Monday.

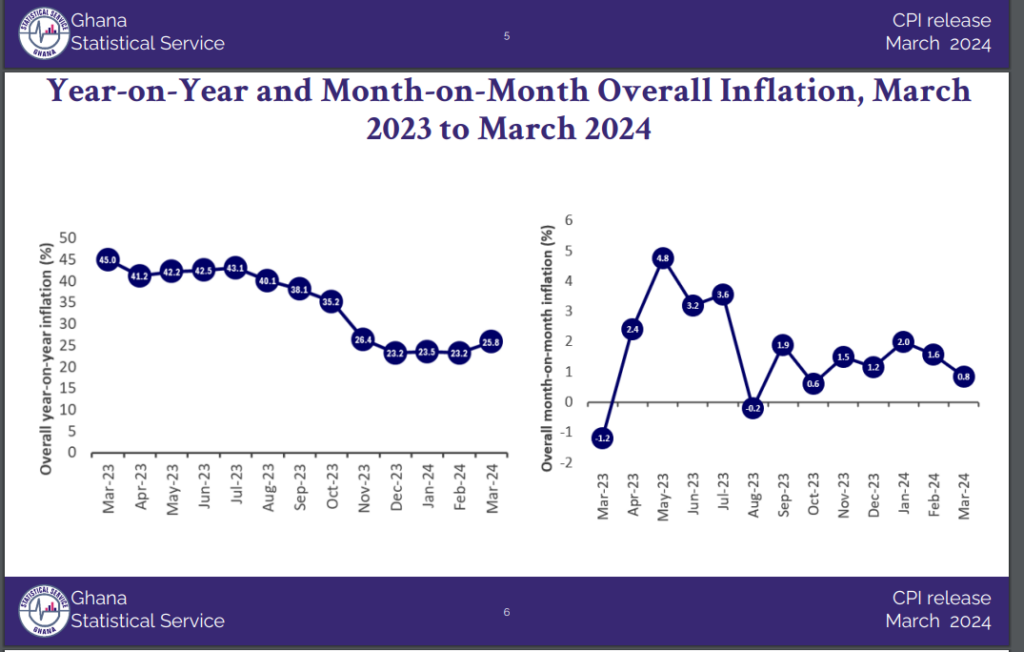

They cite the declining inflation, relative stability of the cedi and government’s pro business agenda as the basis for their claims.“Obviously looking at what is happening on the ground, inflation has been trending downwards for the past three months. Also the exchange rate has been relative stable for the past one week even though it had been threatening for the past few months,” Economist and Lecturer at the University of Ghana, Dr. Lord Mensah told Citi Business News.

According to him, the current 25.5 percent policy rate is a disincentive for businesses hence must be reviewed downward.

“I am expecting a positive decision where the policy rate will be reduced…the current policy rate is even higher than the 91 day T-Bill rates which doesn’t conform to theory,” he added.

The latest Annual Percentage rate and Average Interest report by the Bank of Ghana has shown that average interest on loans is about 33 percent.

Some banks were however cited with interest rates on loans as high as 40 percent and over.

The development according to some market watchers does not favour private sector growth and expansion to create jobs for instance.

Dr. Lord Mensah also tells Citi Business News a reduction of the policy rate to about 23 percent should suffice for business’ growth.

“I also expect that the MPC will reduce the policy rate to go in tandem with the government’s policy where it is expecting lower interest rate and in the end enhancing borrowing in the local economy.”

The Bank of Ghana’s MPC in January 2017 maintained the prime rate at 25.5 percent after it was first reduced in November 2016.

Prior to that, the central bank had kept its policy rate unchanged at 26 percent for a greater part of 2016 as it did not review the figure for about four consecutive times since it was first increased in 2015.

–

By: Pius Amihere Eduku/citibusinessnews.com/Ghana

Economists are highly expectant of a reduction in the policy rate by the Monetary Policy Committee (MPC) of the Bank of Ghana as the Committee prepares to announce its new rate next Monday. They cite the declining inflation, relative stability of the cedi and government’s pro business agenda as the basis for their claims. “Obviously ... Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS