The Emissions Levy Act, 2023 (Act 1112), imposing a levy on carbon dioxide equivalent emissions from internal combustion engine vehicles, has been enforced by the Ghana Revenue Authority starting today, February 1, 2024.

The Emissions Levy Bill, approved by Parliament, imposes an annual charge of GH¢100 on all owners of petrol and diesel cars.

The government’s objective with this tax is to encourage the use of environmentally friendly energy sources for vehicle power, aligning with its commitment to climate-positive actions and carbon offset initiatives.

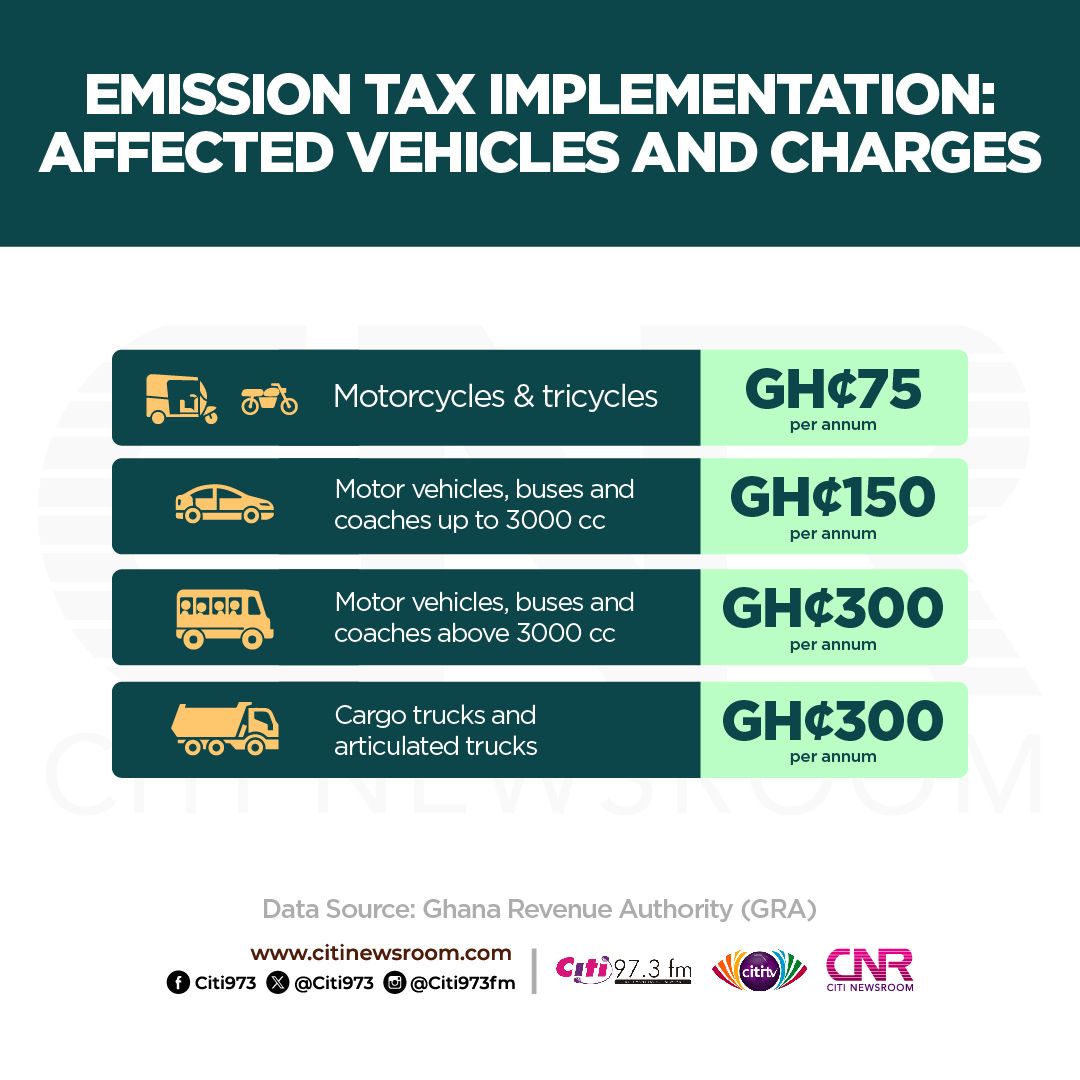

- Motorcycles and tricycles - GH¢75 per annum

- Motor vehicles, buses and coaches above 3000 cc - GH¢300 per annum

- Cargo trucks and articulated trucks - GH¢300 per annum

All persons who are required to pay the Emissions Levy are to register and pay the levy on the ghana.gov platform only. Under section 4(4) of Act 1112, a person required to issue a road use certificate (Driver and Vehicle Licensing Authority (DVLA) and other testing centres) shall demand evidence of payment of the levy before issuing a Road Use Certificate.

The GRA in a public notice published urged all vehicle owners to comply with the directive.

Finance Minister Ken Ofori-Atta had previously announced the government's plan to expand the Environmental Excise Duty to cover plastic packaging, industrial emissions, and vehicle emissions.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS