![Imposition of environmental taxes – The Emissions Levy in Ghana [Article]](http://ghheadlines.com/images/default.png)

At the heels of the year 2023, it was reported that Ghanaian lawmakers had passed a law that had launched the country onto the historical landscape of Africa – the Emissions Tax (the Emissions Levy Act, 2023 (Act1112)).

The introduction of this tax which is quite novel and would make Ghana the third African country to introduce this form of tax also known as the carbon tax, would make history right after such countries as South Africa and Mauritius.

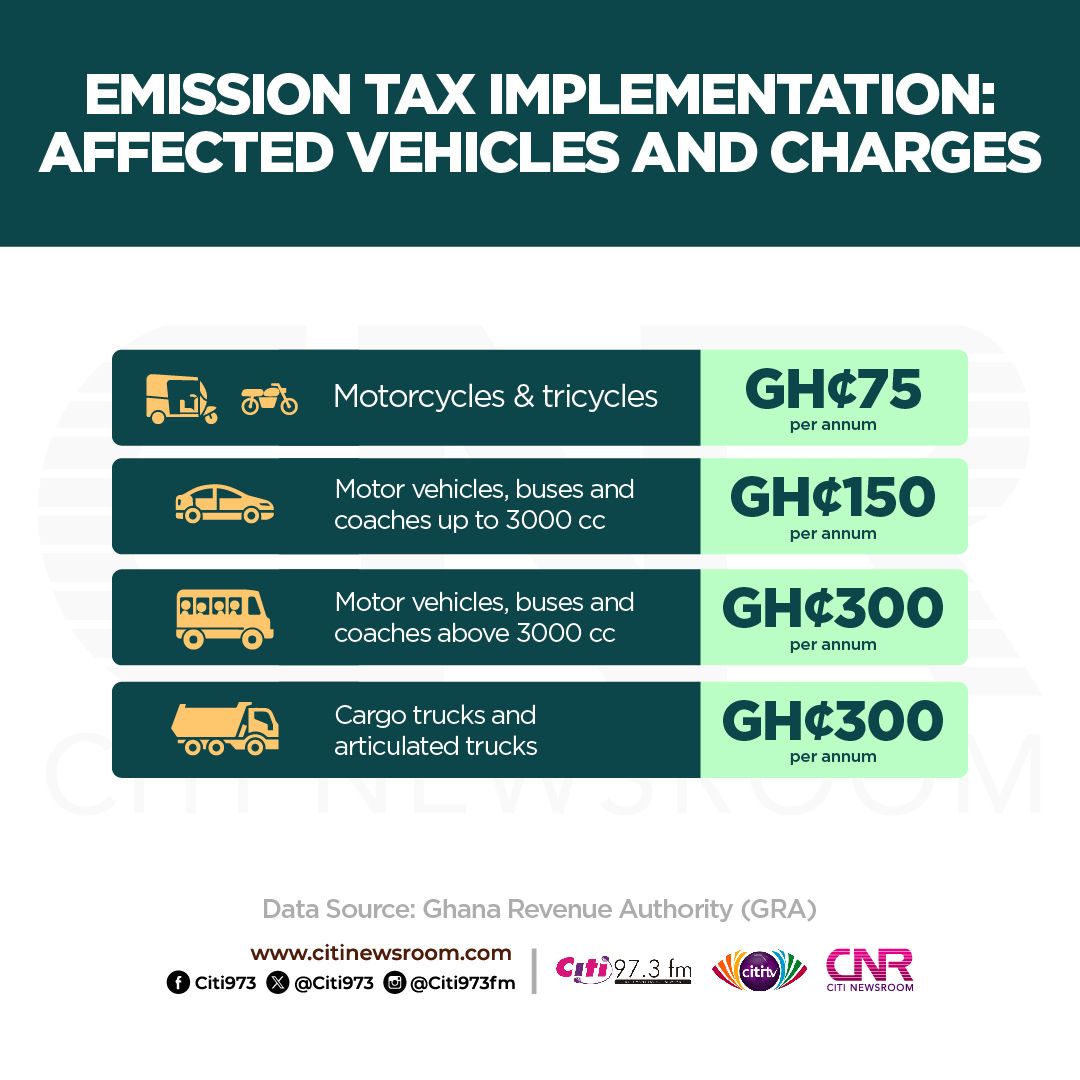

The government agency responsible for the implementation of this law being the Ghana Revenue Authority (GRA), has maintained that the levy is in line with government’s intentions of promoting an economy that is opened to the utilization of “eco-friendly technology and green energy” (BBC News).

This news that should have been considered progressive and welcoming to all, particularly, to environmentalists, was met with great dissension and much resistance.

BACKGROUND

In alignment with international commitments such as the Paris Agreement and the United Nations Framework Convention on Climate Change (UNFCC), the Government of Ghana has taken proactive steps to reinforce the global response to the escalating threat of climate change.

A pivotal component of this strategy involves the implementation of an emissions levy, strategically designed to bolster much-needed domestic revenue mobilization efforts.

This measure not only serves as a financial mechanism but also underscores Ghana’s commitment to mitigating climate change by discouraging excessive greenhouse gas emissions and other related harmful environmental practices.

The imposition of this levy is a crucial step towards fostering environmental responsibility and sustainable practices, contributing to the broader global initiative and campaign for climate action.

Environmental Tax and its Relevance

An environmental tax, also known as an eco-tax, pollution tax or green tax, is a levy imposed by governments on activities of individuals and businesses that have negative environmental impacts. These taxes aim to incentivize environmentally-friendly behaviour, promote sustainable development, and generate revenue for environmental protection and conservation efforts.

In the context of the Ghanaian emissions levy, it serves as an example of an environment tax aimed at reducing greenhouse gas emissions and encouraging the transition to cleaner and more sustainable energy sources. The relevance of environmental taxes, such as emissions levy in Ghana, lies in their potential to address critical environmental initiatives.

By internalizing the costs associated with environmental degradation, these taxes help to correct market failures and promote more efficient resource allocation. This ensures that consumers and firms take these costs into account in their decisions.

Furthermore, environmental taxes can play a crucial role in supporting the achievement of international commitments, such as those outlined in the Paris Agreement and the United Nations Sustainable Development Goals (SDGs).

By aligning with global efforts to mitigate climate change and promote sustainable development, countries like Ghana can demonstrate their commitment to environmental stewardship and contribute to global efforts to address pressing environmental challenges.

The Passage of the Bill

On Tuesday, 19th December 2023, the initial reading of the bill took place, adhering to the standard stipulations outlined in Article 174(1) of the 1992 Constitution. Following this, under the watchful eyes of the Finance Committee, the bill underwent thorough scrutiny and commentary.

Despite facing firm resistance from the minority in parliament, the determined efforts of the majority prevailed, leading to the eventual passage of the bill into law in December, 2023.

This legislative development signifies an important milestone in government’s commitment to addressing pertinent issues, such as the introduction of the emissions levy, even amidst differing opinions within the parliamentary landscape and the citizens of Ghana. The implementation of this law began on the 1st of February, 2024.

PRECEDENCE – THE CASE OF SOUTH AFRICA

South Africa, being the largest CO2 emitter on the African continent, primarily from its electricity sector, and notably with coal power, achieved successful implementation of its carbon tax in June 2019. Two and more decades prior, the country’s emissions’ profile had risen to alarming levels with a total GHG emissions increasing by more than 67 percent in the period of 1990 to 2019 with the energy sector being credited for nearly 86 percent of all emissions recorded. The introduction of the tax was made strategically after introducing and implementing the polluter-pays-principle which was imposed on fuel inputs based on emission factors and procedures which are in conformity with the ideals stipulated by the Intergovernmental Panel on Climate Change.

The only exclusions to the South African emissions tax were agriculture, forestry, land use, and waste. The successful implementation of this law can be attributed to the robust political engagement and extensive stakeholder consultations undertaken by the government of South Africa. The country had also demonstrated a decade-long commitment to inclusive stakeholder processes and intercourses, particularly in the area of developing climate change mitigation strategies.

In contrast, Ghana faces challenges in mirroring South Africa’s success in this regard. The West African nation lacks a comparable history of well-established stakeholder engagement processes for climate change mitigation and advocacy before the implementation of the emissions levy. In the case of the latter, consideration for and engagement of stakeholders took a holistic approach which covered low-income households, industry, areas requiring tax-free thresholds, allowances and others.

But from the reportage from the media on Ghana’s imposition of the emissions tax – from individuals, households and business owners, there seem to first be, a lack of understanding of the pertinent issues surrounding primarily climate change and specifically, taxes that could be imposed as part of mitigation efforts.

Furthermore, South Africa’s proactive approach to this climate change imperative extends beyond policy to investment in diverse transport alternatives, thus, the country seemed prepared on many fronts for implementation of such a law. These include a well-developed railway system, the adoption of lower carbon liquid fuels like biofuels, the integration of electric vehicles as well as building charging networks, and a focus on public transport and cycling. Ghana firstly introduced under the Ministry of Transport, the Electric Vehicle Policy (October, 2023) which is also in compliance with the Nationally Determined Contribution (NDCs) adaptation and mitigation programmes of action, also related to climate change. While this is a laudable step to addressing prevailing climate change challenges, the policy demonstrates a reasonably-thought-through phasing approach to full implementation, taking into consideration (as at 2022) the over 3.2 million vehicles in use in the country.

This policy initiative by the Ministry of Transport seems to have been ignored in the rather swift implementation of the emissions levy – a hint of policy dissonance at play and policies being implemented in silos. Again, Ghana as compared to South Africa, grapples with inadequate transport alternatives such as poor railway systems, poor roads, inadequate charging networks for electric vehicle usage, highlighting a disparity in infrastructure development and sustainable mobility initiatives between the two nations. There is the need for investment in transport alternatives as a prerequisite for the successful implementation of the emissions levy.

The Timing of the Levy

Given Ghana’s inadequate infrastructural facilities and the current economic conditions, the timing of the implementation of the emissions levy may be considered less than ideal. In the last thirty-six months or so, various taxes have been imposed – energy sector levy, E-Levy, special petroleum tax, growth and stability levy, just to mention a few. In line with the broader tax measures proposed by the 2024 Budget, the government aims to increase Ghana’s tax-to-GDP ratio from the current 13% to 18-20% and enhance revenue mobilization.

Key tax measures include extending VAT zero-rating provisions, reducing VAT rates on certain goods, providing import duty waivers and exemptions, and expanding environmental excise duties. These measures align with efforts to promote sustainable development and address environmental challenges, including plastic waste and pollution.

The implementation of the emissions levy will affect citizens in several ways. Firstly, the irate drivers in the media, not comprehending the long-term relevance of such a levy seem poised to pass on the cost of the levy to consumers, and this could inadvertently contribute to an increase in the prices of goods and services, worrisome among them is the eventual additional unreasonable costs that would be passed on to food prices.

This, in turn, may lead to a higher overall tax burden for individuals and businesses as they bear the indirect costs associated with the emissions levy, increasing the general cost of living and the cost of doing business in the country.

The impact on disposable incomes is of significant concern, particularly for lower-income individuals. If prices rise due to the emissions levy, citizens may experience a reduction in their purchasing power, affecting their ability to afford essential goods and services. This, in turn, can contribute to a decline in the standard of living for Ghanaians, particularly those already facing economic challenges and may exacerbate the prevailing problem of brain-drain.

To mitigate the potential negative effects on citizens, policymakers might consider allowing for some time before the implementation of the levy.

The next three years will be ideal for the implementation of the emissions levy and will be agreeable with the other policy initiatives such as the National Electric Vehicle (EV) Policy and others. This would allow continuous stakeholder engagements and advocacy and concurrent investment in diverse transport alternatives.

Furthermore, there is a need for a nationwide public sensitization on the need for the introduction of the Emissions Tax. This will help the general public to understand the rationale for the tax thereby contribute to reducing threats associated with the implementation, strengthening capacities of all the actors, enhance opportunities to develop partnerships as well as to encourage and nurture stakeholder and citizenry participation.

RECOMMENDATIONS

Recognizing the disparities in infrastructural development between Ghana and countries like South Africa, a multisectoral approach to climate mitigation actions should be looked at. Additionally, significant investment in transport alternatives and sustainable mobility initiatives is crucial. These include improving road and railway networks, establishing charging networks for electric vehicles, and promoting the use of public transportation, cycling infrastructure etc.

Such investments will not only support the successful implementation of the emissions levy but also contribute to the achievement of the broader Sustainable Development Goals (SDGs).

Further, considering the current economic conditions and infrastructural deficit in Ghana, policymakers should consider a phased implementation strategy for the emissions levy. This would allow for a gradual transition into full acceptance – providing businesses and citizens with information and adequate time to adjust to the new requirements while minimizing adverse impact on disposable incomes and standard of living.

Finally, the government should outline a clear strategy on how the revenue generated from the emissions levy would be invested in emissions reduction projects to ensure clean energy. This strategy should prioritize transparency and accountability, ensuring that the funds are allocated efficiently and effectively towards initiatives that contribute to greenhouse gas reduction and environmental sustainability.

CONCLUSION

In conclusion, while the introduction of the emissions levy in Ghana signifies a commendable step towards promoting clean energy and mitigating climate change, the structural and climatic preparedness of the country is pivotal for its successful implementation. Policy alignment (multisectoral approach), robust stakeholder engagement, coupled with concurrent strategic investments in infrastructure and a phased approach to policy implementation, are essential to navigate the challenges posed by the levy. Ultimately, the emissions levy should be viewed as part of a broader strategy aimed at fostering environmental responsibility and sustainable development, with careful consideration given to its impact on citizens and the economy.

REFERENCES

2. https://www.bbc.com/news/world-africa-68163587

4. https://www.worldbank.org/en/programs/the-global-tax-program/environmental-taxes

5. https://www.oecd.org/env/tools-evaluation/48164926.pdf

7. https://www.myjoyonline.com/implementation-of-emission-levy-act-begins-feb-1/

8. Ministry of Transport, Draft National Electric Vehicle Policy, 2023.

By: Abena N. Asomaning (PhD.)

Africa Environmental Sanitation Consult (AfESC)

University of Professional Studies Accra (UPSA)

The post Imposition of environmental taxes – The Emissions Levy in Ghana [Article] appeared first on Citinewsroom - Comprehensive News in Ghana.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS