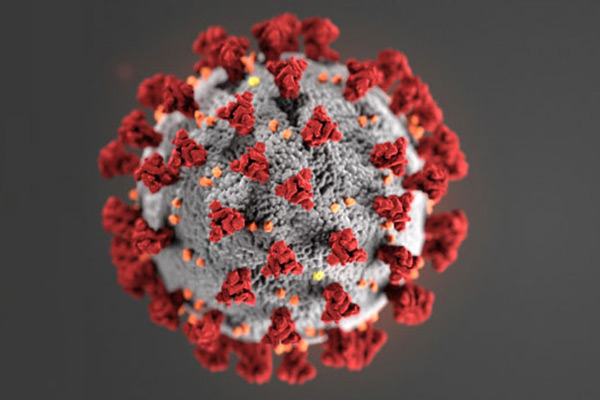

The outbreak of COVID-19 has had a significant impact on global markets, and the oil market is no exception. The oil market has experienced a significant decline in demand, resulting in a drop in oil prices. In this article, we will explore the impact of COVID-19 on the oil market, including the factors that have led to the decline in demand and the measures taken by governments and the industry to mitigate the impact. You can check Oil Profit for more info.

The outbreak of COVID-19 has had a significant impact on global markets, and the oil market is no exception. The oil market has experienced a significant decline in demand, resulting in a drop in oil prices. In this article, we will explore the impact of COVID-19 on the oil market, including the factors that have led to the decline in demand and the measures taken by governments and the industry to mitigate the impact. You can check Oil Profit for more info.

Decline in demand for oil

The pandemic has led to a significant decline in demand for oil as lockdowns and travel restrictions have reduced demand for transportation fuels. The aviation industry has been particularly hard hit, with many flights canceled, and passenger numbers significantly reduced. As a result, demand for jet fuel has dropped significantly. The reduction in demand for transportation fuels has also affected gasoline and diesel demand.

In addition, the pandemic has had an impact on industrial activity, leading to a decline in demand for crude oil used in manufacturing processes. The slowdown in economic activity in many countries has resulted in lower demand for oil, leading to an oversupply of oil on the market.

Oil price war

In March 2020, the oil market was hit by a price war between Saudi Arabia and Russia, resulting in a significant drop in oil prices. The two countries were unable to agree on a reduction in oil production to offset the decline in demand, leading to an increase in supply and a drop in prices. The price war came at a time when the oil market was already experiencing a decline in demand due to the COVID-19 pandemic, exacerbating the situation.

Government and industry measures

Governments and the oil industry have taken measures to mitigate the impact of the pandemic on the oil market. In April 2020, OPEC and its allies, including Russia, agreed to reduce oil production by 9.7 million barrels per day, the largest production cut in history. The reduction in production was aimed at reducing the oversupply of oil on the market and supporting oil prices.

In addition, governments have provided support to the industry, including tax relief and financial assistance, to help oil companies weather the storm. Governments have also implemented measures to support the aviation industry, which has been particularly hard hit by the pandemic.

Outlook for the oil market

The outlook for the oil market remains uncertain, with many factors affecting future demand and supply. The rollout of COVID-19 vaccines and the easing of travel restrictions could lead to an increase in demand for transportation fuels, including jet fuel. However, the pandemic’s impact on the economy could lead to a longer-term reduction in demand for oil.

In addition, the shift towards renewable energy sources could have a long-term impact on the oil market, with some analysts predicting that the pandemic could accelerate the transition away from fossil fuels.

Conclusion

The COVID-19 pandemic has had a significant impact on the oil market, leading to a decline in demand and a drop in prices. The price war between Saudi Arabia and Russia exacerbated the situation, but governments and the industry have taken measures to mitigate the impact. The outlook for the oil market remains uncertain, with many factors affecting future demand and supply.

The post The impact of COVID-19 on the oil market appeared first on Ghana Business News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS