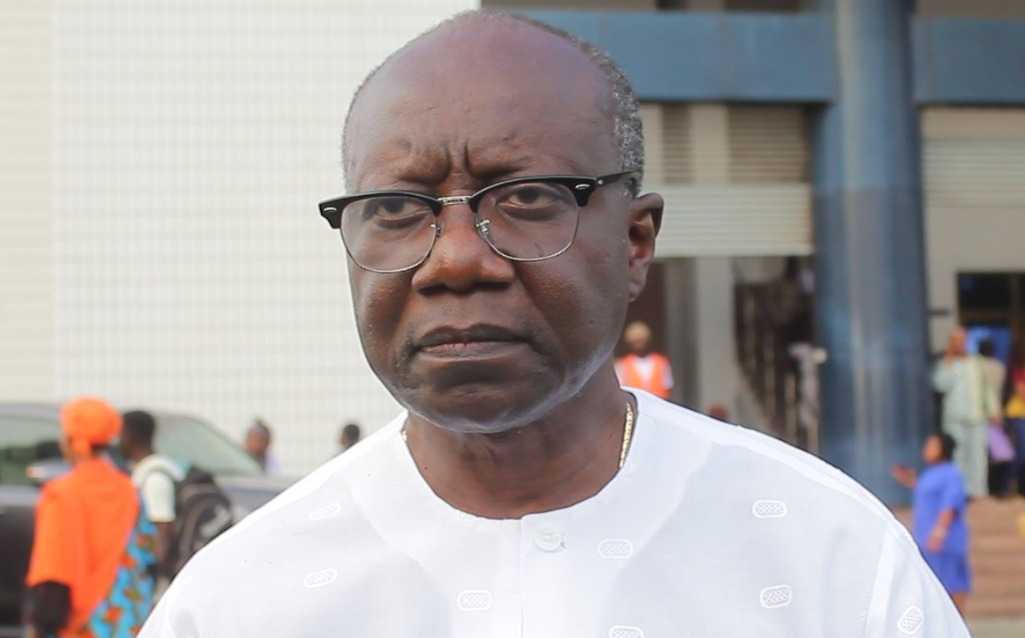

Dr. Ernest Addison

DR. ERNEST Addison, Governor of the Bank of Ghana, has commended GCB Bank for contributing positively to promoting financial intermediation as the second largest bank in credit extension (10.7% share of gross loans as at end-December 2023).

Speaking at GCB Bank’s 70th Anniversary Thought Leadership Conference held recently in Accra, Dr. Addison said GCB Bank has been helping to drive the national agenda of financial inclusion and financial literacy by deepening its reach to the most remote communities through its expansive branch network.

Through consistency and resilience, he said, GCB Bank’s most significant recent contributions to the country’s development agenda include, “Serving as a key facilitator of Ghana’s international trade, with dealings in letters of credit, financing medium-term loans, forward contracts, and export credit guarantee lines, among others.

For example, in March 2023, GCB Bank executed Ghana’s first successful Pan-African Payment and Settlement System (PAPSS) client transaction. A year on, PAPSS has facilitated transactions with twelve Central Banks and signed on 95 commercial banks cross-continent, on the Switch platform, of which 37 are fully integrated.”

“I must commend GCB for its commitment to innovation and continuous evolution in line with emerging trends in the industry. Over the past four years, the bank has demonstrated exceptional fortitude in the face of COVID-19 disruptions and the challenging macroeconomic environment, resulting in the implementation of the DDEP, with its associated impairments.

“Undeterred by this setback, provisional unaudited returns reflect a significant improvement in GCB Bank’s performance. The bank is projected to post profits in 2023, which will help close the capital gap created by the DDEP. Sustaining these profits in the next few years will also contribute to improving the solvency position of the bank. With this, the bank will maintain its resilience well into the future, underscored by continued compliance with the banking sector regulations,” he noted.

Recently, GCB Bank was adjudged the safest bank in Ghana by Moody’s, Fitch, and Standard & Poor’s, and was also voted the most compliant Bank in Africa by the Association for Certified Compliance Professionals in Africa (ACCPA).

“This is testament to GCB Bank’s unwavering dedication to delivering exceptional value to all its stakeholders. Indeed, GCB’s commendable achievements have set the pace in the banking industry, which shows that, given the right conditions (such as sound governance structures and ethical practices), any indigenous bank, even a government-owned one, can perform well, even in the face of strong competition from foreign counterparts,” he averred.

A Business desk report

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS