The Ministry of Finance has indicated that the 2024 budget failed to announce more tax reliefs due to the country’s current economic situation.

Speaking at the 2024 Post Budget Forum on behalf of the Finance Minister, the Chief Director of the ministry, Mends, indicated that the reliefs captured in the 2024 budget were the best the government could do.

“Honestly, it was difficult giving tax reliefs this year because we need every penny that we can get. As we are not getting money from external resources, we needed to protect every penny that we could.”

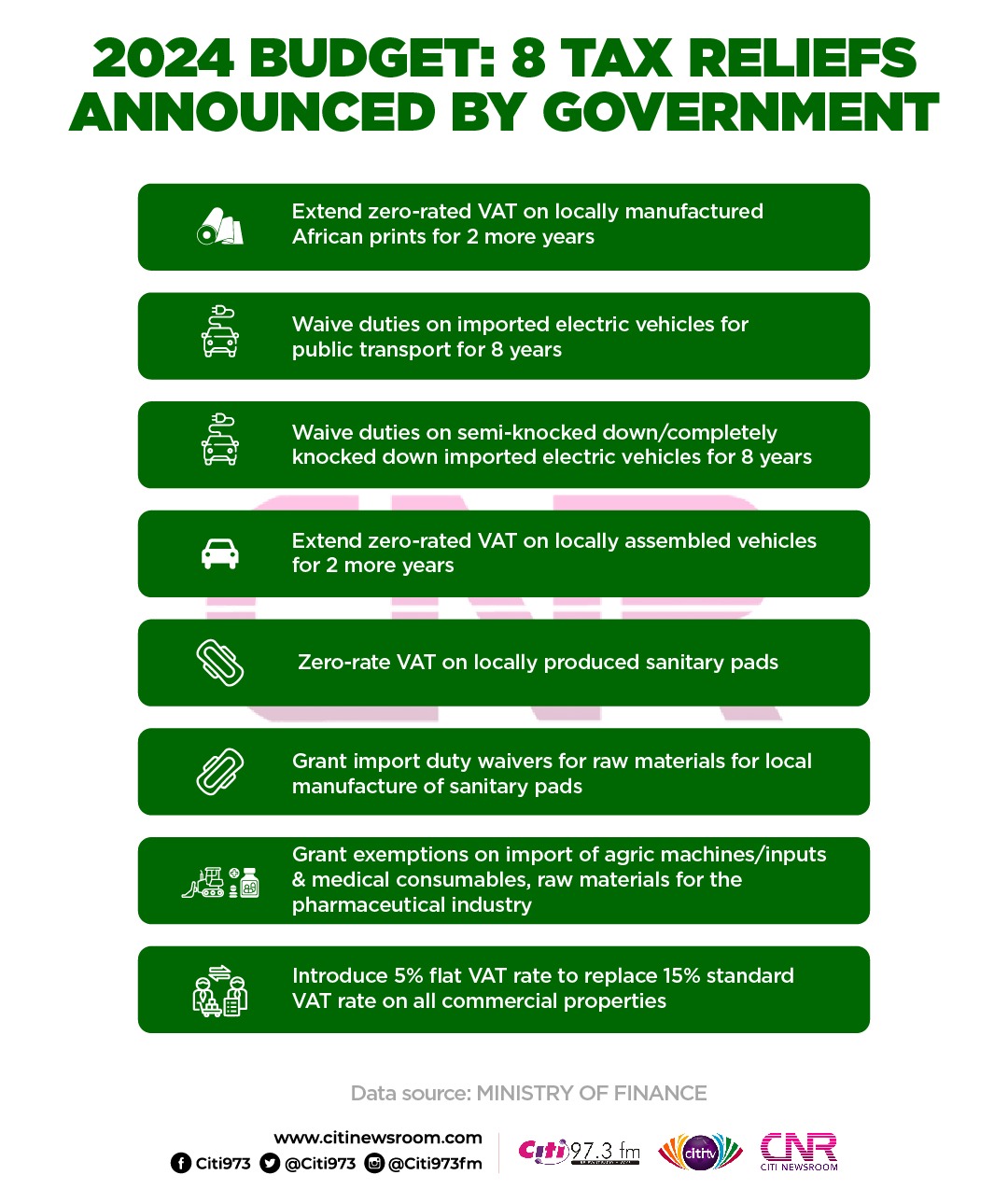

The Finance Minister, Ken Ofori-Atta, on Wednesday, November 15, announced some tax reliefs in his budget presentation made to Parliament.

These include extending a zero-rated VAT on locally manufactured African print for two more years; waiving duties on imported electric vehicles for public transport for eight years; waiving duties on semi-knocked down/completely knocked down imported electric vehicles for eight years; extending zero-rated VAT on locally assembled vehicles for two more years; zero-rating VAT on locally produced sanitary pads; granting import duty waivers for raw materials for local manufacture of sanitary pads; granting exemptions on the import of Agric machines/inputs and medical consumables, raw materials for the pharmaceutical industry, and introducing a 5% flat VAT rate to replace the 15% standard VAT rate on all commercial properties.

The post 2024 budget: It was difficult giving more tax reliefs – Finance Ministry appeared first on Citinewsroom - Comprehensive News in Ghana.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS