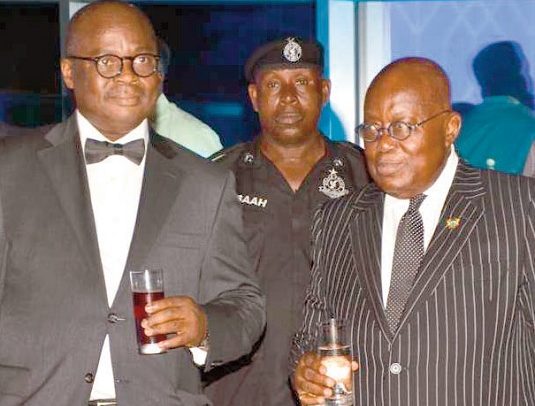

The Director of Research at the Bank of Ghana, Dr. Philip Abradu-Otoo says recent downgrades of Ghana’s creditworthiness compounded the woes of the Ghanaian economy.

Speaking on the Point of View on Citi TV, Mr. Abradu-Otoo said major investors reacted to such ratings and exited the Ghanaian market with their monies.

“At the beginning of the year, we had downgrades somewhere around the first quarter, and in May, we had another downgrade. Anytime we have these downgrades, we see portfolio investors react to these downgrades, and they tend to prematurely disengage from the economy, and they get out of the economy because they fear that their investments may whittle away and anytime they are leaving, they leave with dollars.

“Remember, when they came, they came with dollars to purchase our instruments so when they are going, we must find dollars for them and that puts a lot of pressure on the Central Bank Reserves. And when that happens on top of other commitments that the Central Bank has, it puts undue pressure on the exchange rates and when the exchange rates move, there is a pass-through to inflation and the pricing behaviour of agents in the economy is such that everybody keeps looking at what is happening to the exchange rates.”

Moody’s Investors Service downgraded Ghana’s creditworthiness three times in 2022 with the recent one being in November where it pushed the country’s rating from Caa2 to Ca [junk territory].

Fitch has also downgraded Ghana twice this year.

The post BoG Research Director laments impact of credit downwards on economy appeared first on Citinewsroom - Comprehensive News in Ghana.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS