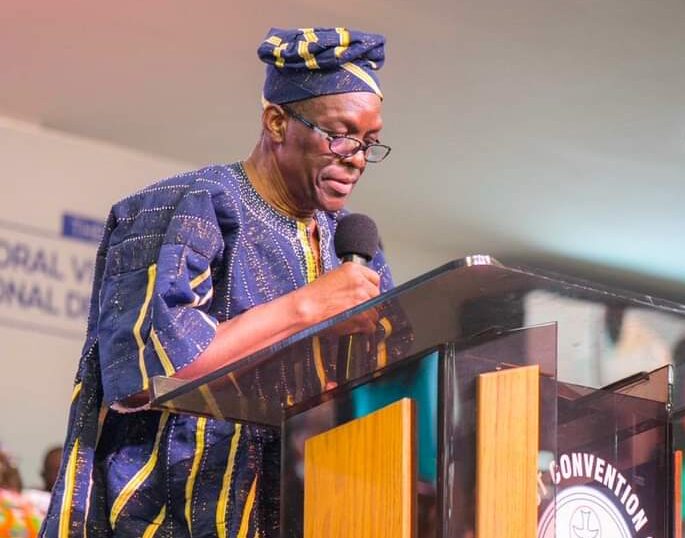

Director of Research at the Bank of Ghana (BoG), Dr. Philip Abradu-Otoo, says Ghana’s inflation-targeting framework is forward-looking.

Ghana’s inflation rate increased to 50.3% in November as against 40.4% recorded in October 2022.

This was captured in the Consumer Price Index (CP1) data released by the Ghana Statistical Service (GSS) on Wednesday.

Speaking on the Point of View on Citi TV, Dr. Abradu-Otoo said the central bank is not surprised by the latest inflation figure, adding that their own projection of inflation would peak in the first quarter of 2023.

“The inflation number we are seeing in November is expected. Given the level of depreciation we saw in October, inflation has just moved to 50.3%. You recall in our MPC press statement, we indicated that inflation will continue to rise. We expected inflation to peak somewhere in the first quarter of 2023 because we have factored in all these events,” Dr. Abradu-Otoo told sit-in host of the Point of View, Selorm Adonoo.

The Director of Research at the BoG explained that the current inflation is mostly driven by aggregate demand pressures in the economy, cost-push measures amongst others, adding that inflation rate has been a difficult one for the central bank.

Dr. Abradu-Otoo further explained, “the inflation story normally comes in many forms. Inflation could come from cost-push measures, it could also come from the fact that there are too many in-built aggregate demand pressures in the economy. Which is stoking excessive demand for goods and services, exchange rates and transport fares. And so when the BoG makes a decision, we weigh these factors that are impugning inflation. The inflation rate has been a difficult one for the central bank”.

He made the clarification when he was asked about a recent critique of the country’s inflation targeting by the Agbogbomefia of the Asogli State, Togbe Afede XIV.

Togbe Afede in a 14-piece opinion said, “it is surprising that the economists at BOG still do not understand that the year-on-year inflation is a historical concept, and that, it is not past price changes that interest rates must seek to compensate for. The relevant inflation rate for fixing the policy rate, in my view, should be expected inflation, adjusted for seasonality, etc. Expected inflation is what astute investors are interested in, much the same way they look at forward price-earnings (P/E) ratios as opposed to trailing P/E ratios in evaluating shares for investment purposes”.

Reacting to this, Dr. Abradu-Otoo said, “our [Ghana] inflation-targeting framework is forward-looking. Anytime we set interest rate, we don’t set interest rate based on previous inflation, but we set interest rate looking at inflation horizon over a year. So we see that inflation, maybe in a year’s time, will be 25%, we set interest rate based on that one year forecast of inflation”.

Though he reckoned with Togbe Afede’s suggestion on inflation, he said the central bank setting monthly rate of inflation has its own pitfalls.

“Togbe Afede has a point, I recall at the time when he was on the central bank board, he kept saying that we needed to set policy based on the monthly rate of inflation. So he was even at that time saying that look, don’t do the year-on-year, because if you look at the year-on-year, you might set high interest rate which will kill the economy.

“Just look at the monthly which is an inflation where we peaked 5.1%, set your policies, interest rates based on inflation. But that has its own pitfalls as well,” the Director of Research at BoG explained.

The post Ghana’s inflation-targeting framework is forward looking -BoG’s Abradu-Otoo appeared first on Citinewsroom - Comprehensive News in Ghana.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS