By Dennis AKWABOAH

As the digital assets ecosystem in Ghana evolves, firms operating within or seeking to expand into this space must prepare for impending regulatory oversight.

The Draft Guidelines on Digital Assets issued by the Bank of Ghana in August 2024 provide a clear indication of the regulatory direction, emphasizing consumer protection, financial stability, and the mitigation of financial crimes. Below are key priorities that businesses should focus on to position themselves for success in this rapidly evolving landscape.

- Engage early with regulatory bodies

For companies offering or intending to offer digital asset products, early and continuous engagement with regulators, such as the Bank of Ghana and the Securities and Exchange Commission (SEC), is critical.

The draft guidelines emphasize the importance of proactive communication with these agencies, particularly as the regulatory framework for Virtual Asset Service Providers (VASPs) is still developing.

Establishing a collaborative relationship early on will help firms navigate compliance issues more efficiently and ensure a smoother regulatory approval process. Moreover, firms should be prepared to educate regulators on new technologies, business models, and risk mitigation strategies, as these are areas of concern for oversight bodies unfamiliar with evolving financial technologies.

- Develop a strategic vision

Defining a clear strategic rationale and business case for entering the digital assets space is paramount. Firms must articulate how digital assets fit into their overall business strategy and align with the broader financial ecosystem.

Whether it’s leveraging blockchain for cross-border payments or tokenization for new asset classes, companies must present a vision that addresses the economic opportunities and mitigates potential risks outlined in the guidelines, such as consumer protection, money laundering (AML), and counter-terrorism financing (CFT) concerns.

- Risk management and compliance

Companies will need to enhance or build enterprise risk management frameworks that are adaptable to the unique risks posed by digital assets. This includes a focus on:

- Inherent and residual risks: Identifying the specific risks related to digital assets, including market manipulation, fraud, and cybersecurity.

- Financial crime prevention: The Bank of Ghana’s guidelines emphasize the necessity for comprehensive risk assessments. VASPs will be required to implement rigorous AML/CFT protocols, aligning with FATF standards. This includes customer due diligence, transaction monitoring, and the reporting of suspicious activities.

- Consumer protection: Firms must demonstrate a robust understanding of how they will safeguard client assets and data. Compliance with privacy laws and the integration of consumer risk disclosures are crucial for regulatory approval.

- Cybersecurity and information security

With digital assets heavily dependent on secure, resilient systems, cybersecurity is at the forefront of regulatory concerns. The Bank of Ghana will closely scrutinize how firms protect sensitive data, from transaction information to personal customer data. This includes:

- Security protocols: Controls over transaction signing, key management, and the physical security of digital assets.

- Cyber risk assessments: Regular assessments to detect and respond to emerging threats.

- Business continuity: Developing robust plans to ensure that operations continue seamlessly in the event of a cybersecurity incident or system outage.

- Third-party risk management

Many companies rely on third parties for essential services such as custodial services, wallet management, and exchange operations. These relationships introduce additional risks, which must be addressed through a rigorous third-party risk management (TPRM) framework.

Firms must ensure that their third-party partners comply with local regulations and global best practices for cybersecurity, data privacy, and consumer protection. The Bank of Ghana may require firms to disclose how they manage these relationships and ensure the resilience of their operations.

- Governance and accountability

Strong governance structures are critical to meeting regulatory expectations. The Board and senior management of firms will need to define and oversee risk management strategies, ensuring that policies and procedures align with regulatory requirements. The draft guidelines stress that governance is a backbone of risk management and that firms must demonstrate consistent monitoring, testing, and updating of their governance frameworks. This includes:

- Risk appetite: Clearly defined risk appetite statements tailored to digital assets.

- Compliance oversight: Ongoing internal audits and compliance reviews to ensure adherence to laws, regulations, and internal policies.

- Capital and liquidity management

Firms expanding into digital assets will need to show that they can maintain sufficient capital and liquidity to safeguard customer funds, particularly during periods of financial stress. The Bank of Ghana’s draft guidelines outline expectations around financial resiliency, including how firms manage liquidity and capital buffers.

For those affiliated with parent companies, regulators will also assess how the parent entity can backstop the firm in times of crisis. This also ties into maintaining profitability and ensuring that digital asset offerings do not compromise the overall financial stability of the firm.

- Consumer education

Given the nascent nature of digital assets, firms must commit to educating their clients about the risks involved in dealing with these products. The Bank of Ghana emphasizes the need for adequate disclosures to ensure that consumers are fully aware of potential risks, such as price volatility, cybersecurity threats, and fraud. Firms should incorporate transparent and accessible risk disclosures into their service models and take steps to enhance consumer protection measures.

- Long-term sustainability and resolution planning

The draft guidelines hint at the importance of sustainability in the digital asset space. Firms need to consider long-term operational viability, including staffing and resource allocation for compliance and risk management. As firms scale their digital asset offerings, they must also develop resolution plans, similar to those in the banking sector, to ensure orderly unwinding in case of business failure.

Conclusion

By focusing on these priority areas, firms operating in the digital asset space or those seeking to expand into it from traditional financial services can better prepare for regulatory oversight. With the Bank of Ghana’s guidelines expected to evolve, early preparation and strategic alignment with these best practices will be essential for firms to thrive in Ghana’s emerging digital asset ecosystem.

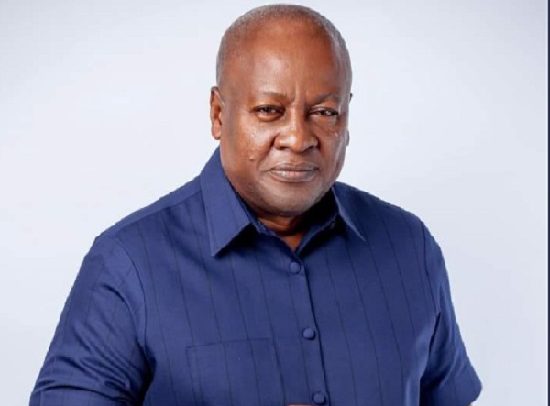

>>>the writer is an Associate at Sustineri Attorneys PRUC with its Technology and Emerging Innovations, Corporate, Tax and Trade Practice Group, specializing in legal service provision for Startups and SMEs, Fintechs, and other Technology companies. He welcomes views on this article via [email protected]

The post Preparing for digital asset regulation – key considerations for companies appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS