Nigeria’s troubled economy will record tremendous improvement by the third quarter of the year, the Central Bank of Nigeria (CBN), has predicted.

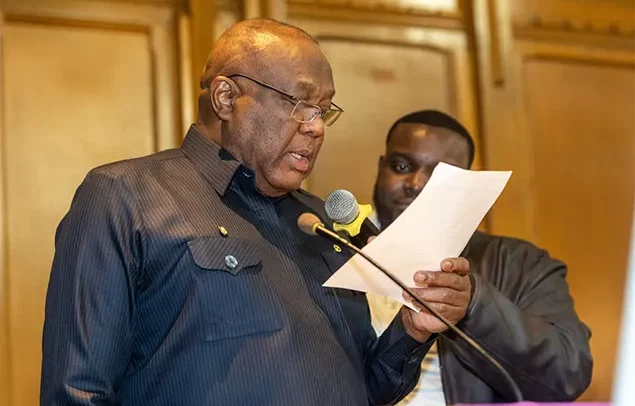

The Director of Banking Supervision of CBN, Mr Ahmed Abdullahi, told newsmen that the prediction was the outcome of the 333rd Bankers’ Committee meeting in Lagos.

According to him, this is because the foreign exchange rate has remained stable as there is convergence between the official and parallel markets.

He also said that investors’ confidence in the economy was gradually building up as was indicated in downward trend in the inflation rate and the positive development recorded at the capital market.

“The Bankers Committee noted with delight the improvement in the economy in recent times. Although the economy is still in the negative but the size of the negative growth has reduced.

“It is almost obvious that by the end of the third quarter, there will be positive growth and there are a number of indices that are pointing toward that.

“Inflation is trending downwards. It is about 16.25 per cent from 18 per cent that it was.

“The exchange rate has largely stabilised,” and the director added that confidence was increasingly building in the economy, saying that it was due to improvement in oil production and oil price.

“The economy will remain robust now that there is upward growth in most of the sectors of the economy.

“The nafex window in the last six weeks shows over two billion dollars has been reregistered as inflow and that has helped in stabilising the market.

“With other windows, we have seen activities that have helped in building confidence in the market generally,’’ he said.

The Managing Director of Standard Chartered Banks, Mrs Bola Adesola, gave an update on the agriculture and small enterprise equity fund.

Adesola said that the equity fund was a decision reached after the last Bankers’ Committee’s retreat in May.

Also speaking, Mr Nnamdi Okonkwo, the Managing Director of Fidelity Bank, said there were also discussions on issues that could jeopardise financial inclusion and anything that would stop people from being included in the formal financial sector.

“We will work to ensure that bottlenecks are removed.

“One key issue that came up today is customers of Micro Finance Banks who do not yet have their Bank Verification Numbers (BVN) registered.

“Some feedback that we got at the committee was that some banks charge customers when they try to register.

“So the bankers’ committee agreed today that MFB customers can walk into any bank and register their BVN free of charge to make sure that we don’t discourage people from being financially included.” (NAN)

Source: PerSecond News

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS