Zimbabwe’s central bank said Monday it is currently processing Barclays’ application to sell 68 percent of its shareholding in the Zimbabwe unit to Malawi-based First Merchant Bank.

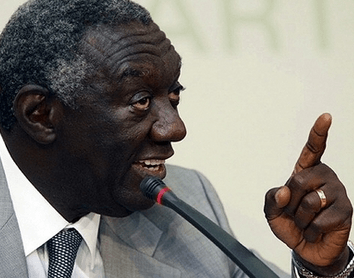

The Reserve Bank of Zimbabwe Governor John Mangudya told a portfolio committee of parliament that the deal complied with the country’s indigenization policy, contrary to concerns raised in some quarters.

Zimbabwe’s indigenization policy stipulates that foreigners must own a maximum of 49 percent of shareholding in a company while the majority 51 percent is reserved for locals.

There had been concerns raised in some circles that the deal flouted the indigenization policy, with some urging President Robert Mugabe to reverse the deal.

Barclays staff in Zimbabwe was reportedly contesting the takeover, and had appealed to the country’s high court to block the transaction.

However, Mangudya said Barclays was in effect selling 43 percent of its shares in the Zimbabwe unit, which is below the 49 percent threshold for foreign investors.

He clarified that of the 68 percent being disposed of by Barclays, 32 percent would remain listed on the Zimbabwe Stock Exchange, 15 percent will be offered to employees and management while 10 percent would be retained by Barclays Plc for the next three years to ensure business continuity.

“When you look at it the shares that are actually being sold are 43 percent. This is below 49 percent reserved for foreigners,” Mangudya said.

Barclays’ disposal of the Zimbabwe unit, announced end of May, ends its 105-year presence in Zimbabwe.

Barclays first established a presence in Zimbabwe when it was still a British colony in 1912.

Barclays Bank Zimbabwe is listed on the Zimbabwe Stock Exchange and has a market capitalization of 73 million U.S. dollars.

The deal leaves Standard Chartered Bank as the only Western bank operating in Zimbabwe.

Barclays will transfer all of the bank’s 700 employees, 25 retail branches and five corporate service centers in Zimbabwe to First Merchant Bank.

Barclays has also cut its stake in its main African operation from 50 percent to 15 percent, selling control of the Johannesburg-listed business as it continues its exit from Africa. Enditem

Source: Xinhua/NewsGhana.com.gh

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS