The Atwima Kwanwoma Rural Bank recorded a growth in profit before tax from GH¢9,441,868 in 2022 to GH¢24,712,060 in 2023 representing growth of 161.73%.

Its profit after tax moved from GH¢6,974,035 in 2022 to GH¢17,167,737 in 2023 representing an increase of 146.17%.

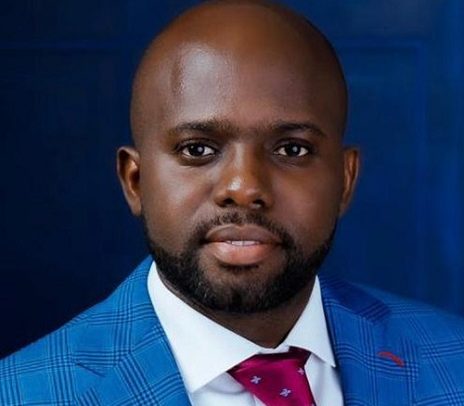

Mr. Kwame Kyei Kusi, the Board Chairman of the Bank who announced this feat at the 41st Shareholders Annual General Meeting said that in spite of the national and global economic challenges in the financial year, the Bank continued to record strong performance for the year under review, in comparison to 2022 financial year.

According to him, year on year performance shows momentous growth with the key performance areas such as Deposits, Investments, Paid-up capital and Total Assets and others.

The Board Chairman indicated that at the end of the financial year 2023, the Bank’s total deposit stood at GH¢378,072,248 as against GH¢293,938,997 in the previous year, recording a percentage increase of 28.62%.

He said Investment portfolio also grew from GH¢227,427,147, in the year 2022, to GH¢297,782,142 in the year 2023 representing an increase of 30.94%.He disclosed that the Bank’s total loan portfolio stood at GH¢76,652,534 in the year under review as against GH¢57,818,466 in 2022, an increase of 30.94%

He revealed an increase was recorded in the Bank’s Total Assets from GH¢356,743,095 in 2022 to GH¢ 460,036,059 in 2023, representing a growth of 28.95%.

Mr. Kyei Kusi disclosed that the Bank’s Stated Capital increased to GH¢3,929,712 at the end of the year 2023, up from GH¢3,550,565 in the previous year resulting in an increase of GH¢379,147 representing 10.68%.

He disclosed that as a requirement by the Bank of Ghana (BOG), all Rural and Community banks are to meet a minimum stated capital of GH¢1 million but the the Bank recorded an increase in its shareholders Fund from GH¢48,150,683 in 2022 to GH¢64,295,077 in 2023 representing 33.53% growth.

He appealed to the shareholders to buy more shares since the Bank of Ghana may very soon increase the minimum requirement.

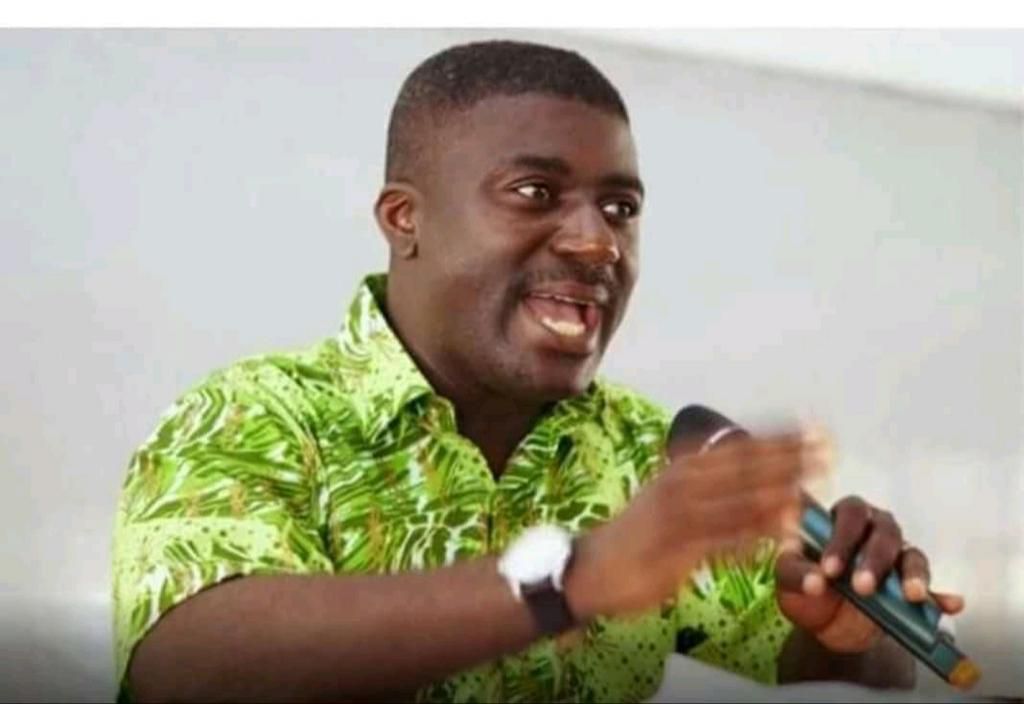

Mr. Samuel Bonsu Sekyere, Chief Executive Officer the Bank said the bank was focused on increasing deposits to be in business.

He disclosed that management has intensified efforts in deposit mobilisation and opened a new branch at the Central Business District (CBD) of Kumasi towards bringing customers closer to the doorstep of the bank.

The post Atwima Kwanwoma Rural Bank makes GH¢17 million profit after tax appeared first on The Ghanaian Chronicle.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS