He diagnoses that the silence has been occasioned by a budget policy that has proven controversial, the E-levy contained in the Electronic Transactions Levy.

"The E-Levy has imposed a culture of silence on our usually loquacious Vice President Bawumia," Kwakye Ofosu posted on Twitter.

The 1.75% tax on electronic transactions including on inward remittances and on mobile money transfers became a sticking point in the approval of the 2022 budget statement.

While the government mounts a robust defense of the levy, the Minority state that at best the levy needed to be brought down to 1% from the 1.75%.

“A week ago, it was no no no, we won’t accept e-levy but having listened to officials in government, including the Minister of Finance.

“I am convinced to accept a departure from my original "no" to accepting a one percent e-levy,” he said.

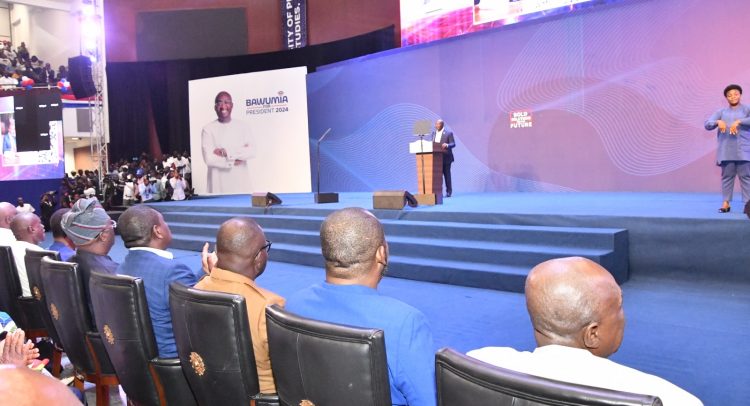

Weeks back, Kwakye Ofosu had alleged that the E-levy was introduced to Ghanaians via a digitalization lecture Bawumia delivered at Ashesi University.

“…that whole hoopla around digitalization at Ashesi was to prepare our minds for this Bawumia tax. It was to create the impression of some major shift, some seismic activity to justify the need to pay taxes.

“And it is little wonder why people have called this Bawumia tax, because that is what it is. That whole digitalization propaganda was intended to provide a rationale for levying Ghanaians on this particular matter.”

What Ofori-Atta said about 1.75% levy on electronic transactions

Ken Ofori-Atta introduced a new 1.75% levy on all electronic transactions such as Mobile money transactions, remittances and other electronic transactions.

Fees and charges of government services have also been increased by 15%.

The Finance Minister explained, “It is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the informal economy.

"As such government is charging an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances, which shall be borne by the sender except inward remittances, which will be borne by the recipient.

"To safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GH¢100 or less per day, which is approximately ¢3000 per month, will be exempt from this levy,” Ofori-Atta revealed. Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS