He said he has been convinced to accept it

He made these comments during the 10th Anniversary launch of the Ghana Chamber of Telecommunications

Haruna Iddrisu, the Minority Leader in Parliament, has softened his position on the government of Ghana’s electronic transactions levy [e-levy] imposed on mobile money transactions, remittances and other electronic transactions.

Speaking at the 10th Anniversary launch of the Ghana Chamber of Telecommunications in Accra on Thursday, the Tamale South MP, the Minority Caucus in Parliament will accept a reduction of the proposed e-levy to 1% from the original 1.75%.

“A week ago, it was no no no, we won’t accept e-levy but having listened to officials in government, including the Minister of Finance, I am convinced to accept a departure from my original "no" to accepting a one percent e-levy,” Iddrisu said at the launch.

He noted that when the e-levy is pegged at one percent, it will be a great contribution to fiscal consolidation and would ensure the economy did not collapse going forward.

The digital economy, according to Haruna Iddrisu, was doing well and had facilitated a revolution in financial inclusion, hence it was unwise to overburden the telecommunication sector.

“We are not against it but we want it fixed at one percent. We fear for double taxation because we already have the communication services tax,” he said.

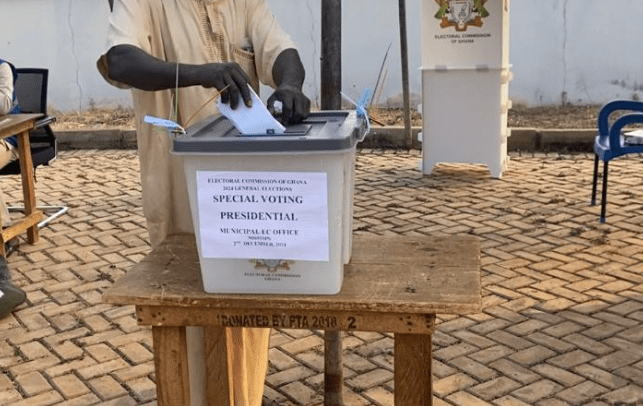

Haruna Iddrisu and his Minority Caucus initially disagreed with the deduction fee for business transactions not exceeding the GHC100.00 threshold a day and called for it to be pegged at GHC500.00.

He, in a similar vein, suggested that the money be pegged at GHC300.00 after revising his notes.

Haruna Iddrisu observed, Ghanaians needed to pay tax to help develop the country but not one that would further put constraints on their tight purse.

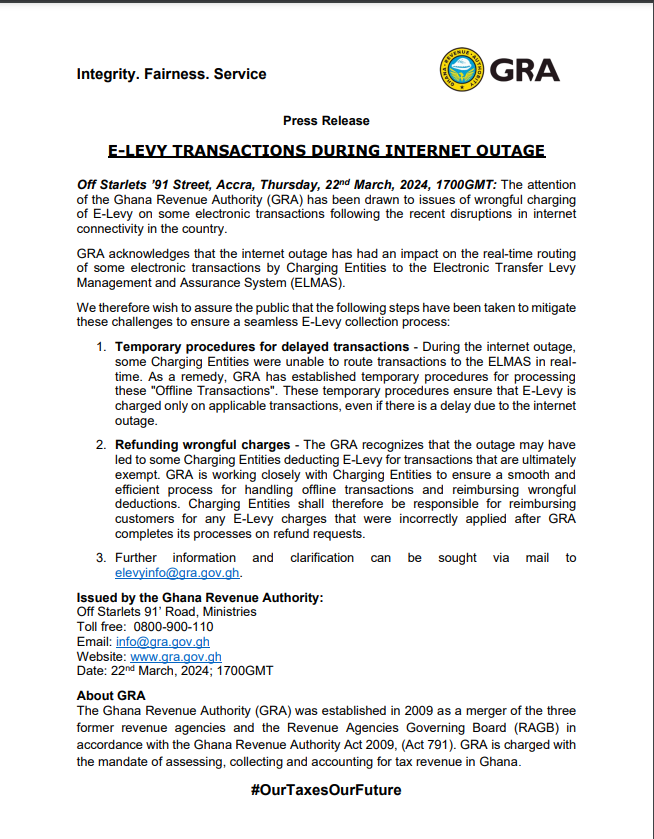

1.75% levy on electronic transactions

Ken Ofori-Atta introduced a new 1.75% levy on all electronic transactions such as Mobile money transactions, remittances and other electronic transactions.

Fees and charges of government services have also been increased by 15%.

The Finance Minister explained, “It is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the informal economy.

"As such government is charging an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances, which shall be borne by the sender except inward remittances, which will be borne by the recipient.

"To safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GH¢100 or less per day, which is approximately ¢3000 per month, will be exempt from this levy,” Ofori-Atta revealed. Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS