• Prof. Quartey also believes the success of the bank will be hinged on its business module

• He adds that the operations of the bank must also be devoid of political interference

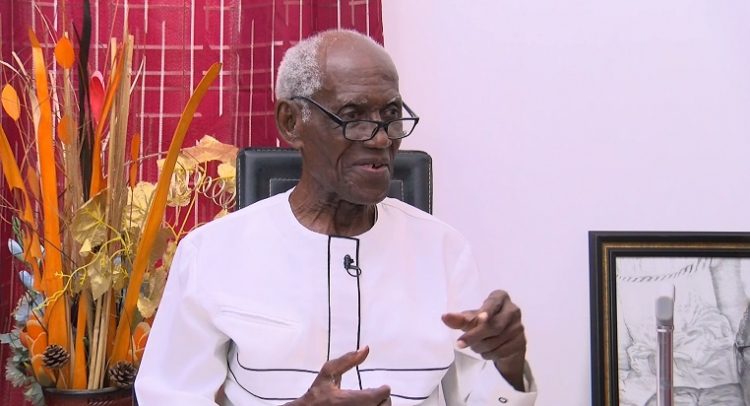

Head of the Institute of Statistical, Social and Economic Research (ISSER), Prof. Peter Quartey, has said the success of the yet to be established National Development Bank (NDB) will largely depend on the appointed personnel to run the entity.

According to him, the NDB must further operate in a well efficient business module which will be devoid of political interference.

Making his submission during a presentation at a public dialogue organised by ISSER on the theme; “National Development Bank and Sustainable Financing in Ghana”, Prof. Quartey lauded the idea of establishing the bank.

“There is no doubt that we need long-term financing. What we are providing is short-term, but certain investments require long-term financing. Unfortunately, we have given our banks universal licences and so all of them go into retail and other more profitable ventures than lending to the sectors which will transform the economy – and that’s why we need a national development bank,” Prof Quartey said.

He added that key lessons must be learned from other successful development banks which have strong structures that enable them to appoint those qualified to lead the bank.

“National development banks have been successful in other countries. However, their success is dependent on whether they are run like a business, or if they are just operated like any state-owned entity wherein, we appoint cronies to boards or management, or government appointees who are less qualified to manage the bank and so on and so forth.”

The economist further said the NDB must also run independently with regards to advertisement and recruiting of competent staff at key positions of the bank to avoid a reoccurrence of a financial sector clean-up.

“What we need is an independent national development bank that is able to advertise and recruit competent staff; that is able to appoint boards of different backgrounds with the highest level of competencies and operate like a business. If we are able to do this, we are certainly going to be successful; and it will help transform our economy, create jobs and improve livelihoods,” he said.

Meanwhile, Ghana through the Ministry of Finance secured some €170 million from the European Investment Bank for establishment of the bank.

The decision to set up to the bank, according to government, is it will serve as a wholesale entity that will offer guarantee investment instruments to woo in universal banks to lend to critical growth sectors.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS