A paper prepared by IMF’s Vitor Gaspar and Gita Gopinath said COVID-19 has aggravated the tension between large development needs and scarce public resources.

To raise the much-needed revenue, he said governments will need to strengthen tax systems. This is especially challenging as tax competition, issues in allocation of the tax base, and aggressive tax planning techniques have put income taxation under pressure.

But raising revenue is possible, he said, adding that it will have to be carried out in a way that promotes growth and favours inclusiveness. Governments should look to improve efficiency, simplify tax codes, reduce tax evasion, and increase progressivity. Strengthening state capacity to collect taxes and leveraging the role of the private sector will also be key. As long as the pandemic persists, fiscal policy needs to remain agile and responsive to the ever-evolving circumstances.

“Collective actions can help narrow divides. The Next Generation European Union (NGEU) fund, of which 50 percent is grants, has been an important financing source for EU member states with limited fiscal space. Access to NGEU support and low borrowing costs are decisive factors explaining the projected lack of divergence between advanced and emerging market economies in the European Union."

“The international community accordingly will have to play a major role in securing financing for the most vulnerable countries. The recently approved general allocation of $650 billion of SDRs by the IMF will provide countries with additional liquidity cushions and help them address the difficult policy trade-offs they face."

“The channeling of SDRs from rich nations to developing nations will further boost this support. The IMF is engaging with its members on a new facility—the Resilience and Sustainability Trust—aimed at helping emerging and developing economies meet the challenges of climate change and build resilient economies. This assistance alone will not suffice, however; other sources of donor support will also be needed."

“An encouraging sign is the historic international corporate tax agreement endorsed by more than 130 countries. The agreement includes a corporate income tax rate floor of at least 15 percent. It will stop the race to the bottom in international corporate tax. It is crucial to work out the details so that the agreement helps deliver resources for crucial investments in health, education, infrastructure, and social spending in developing countries."

“This promising sign shows a window of opportunity. The urgency of global challenges—COVID-19, climate change, and inclusive development—requires global action. This is a decisive moment in history. 2021 should be the year of coming together.”

Meanwhile, the government of Ghana is not raising revenue in the second half of the year 2021.

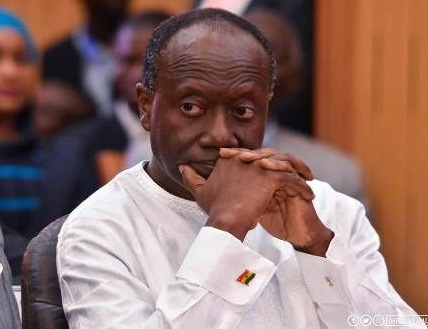

Finance Minister Ken Ofori-Atta told Parliament during the delivery of the mid-year budget statement on Thursday, July 29 that he did not come to ask for more money from the House.

He also said he did not come for more taxes rather, he came to update the House and the country on the performance of the economy during the first half of the year.

“I have not come here today to ask for more money, I have not come to ask for more taxes, I have come to update the house on the performance of the economy for the first half of the year,” he said amidst claps from members of Parliament. Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS