He mentioned that the Bank of Ghana should instead concern itself on ensuring a good corporate governance in the banking sector rather than having finances of banks stretched-thin over high recapitalization demands.

Read the full story originally published on August 12, 2018, on GhanaWeb

Bank of Ghana should concern itself more with enforcing good corporate governance in the banking sector rather than having finances of banks stretched-thin over high recapitalization demands.

The idea that every bank should be “big” is misplaced, however the financial market regulator should focus on whipping banks in line with regulatory measures by ensuring loans and risks assessments are format complaint

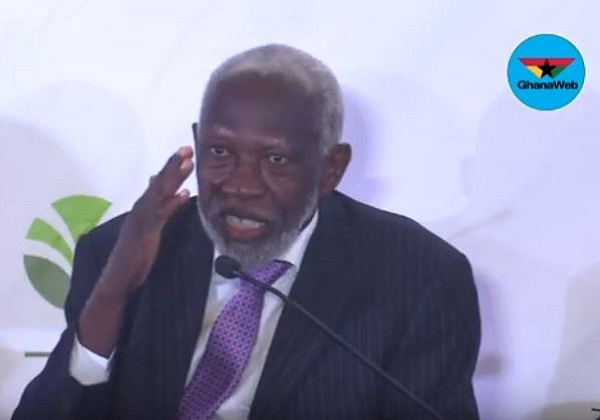

These are the thoughts of former Rector of the Ghana Institute of Management and Public Administration (GIMPA), Professor Stephen Adei.

Prof. Addei backlashed the Central Bank describing the increment in the minimum capital requirement as unacceptable.

Taking his turn on GhanaWeb’s “21minutes with KKB”, the economist argued that the so-called big banks, which operated over a long period of time and gained income only managed to transfer such funds into Stated Capital for trading.

According to Prof. Adei, the Bank of Ghana should have helped the smaller banks out of their insolvency rather than raising their minimum capital requirement.

“There are small banks in America with capitals smaller than half a million dollars. I think what the Bank of Ghana should be concerned with, is they do proper banking and not the idea that they should become big. Within a space of 4 years or so they have moved from 25million minimum capital to 40 to 60 to 120 and now 400million. Bank of Ghana asking local banks to grow big is not done. Let them grow but don’t rush them,” he said.

Prof. Adei’s comments come after Bank of Ghana (BoG) last week revoked the licences of five universal banks, namely, Royal Bank, Construction Bank, Sovereign Bank, uniBank and BEIGE Bank.

According to the Central Bank, the action was taken due to the inability of the banks to meet existing minimum capital requirement.

Some of the troubled banks also faced liquidity issues while others obtained their licences through dubious means. Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS