He said the government took a bad political decision to collapse banks that needed bail out and strict guidance, adding that “it cost the country about 20 billion yet people have lost their jobs and depositors can’t have their savings back.”

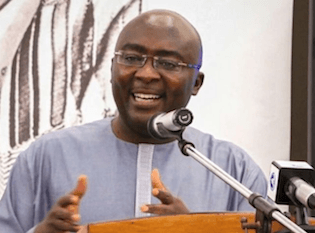

Describing the decision that has locked up funds of thousands as “cruel”, Mr Opoku, a Member of Parliament (MP) for Asunafo South, said the government knew “9 billion could have saved the banks but rather decided not to do that hence resulting in the loss of jobs for thousands.”

“The economic impact is worse,” he told Dwaboase host Kwame Minkah as he explained that “government could have appointed partners to manage the banks and get them back on track to save jobs.”

“Now the so called reforms cost us a lot yet people have lost their jobs and depositors can’t have their savings back. Unibank [one of the banks that was collapsed] had over 3,000 employees but they had to lose their jobs. What are they going to eat? how do their dependants going to survive?,”” Mr Opoku quizzed.

Background

In the past two years, the Bank of Ghana’s reforms has led to the collapsed of nine local banks, 347 microfinance institutions and some 23 finance houses.

On 1 August 2018, the Bank of Ghana announced the consolidation of the failed local banks, which included the Royal Bank, Beige Bank, Construction Bank, Sovereign Bank and uniBank. Later on, HBL and Premium Bank were added to the first five.

The collapse of the nine local banks birthed the state-owned Consolidated Bank Ghana (CBG) Limited.

This was after the Central Bank on 14 August 2017 approved the takeover of UT Bank and Capital Bank, by the state-owned GCB Bank Limited.

More than 152,000 depositors have been affected since the these Micro Finance Institutions, Savings and Loans Companies and banks were folded up for what the government described as their inability to meet liquidity standards.

Some frustrated customers, some of which have been ejected from their homes for their inability to pay their rent, as businesses of others have suddenly collapsed resulting in sleepless nights and hunger among thousands.

Promises

Following demonstrations upon demonstrations for their monies; curses, assurances have been given by the government to refund the deposits amidst modalities, but till date tens of thousands have virtually been disappointed even after President Akufo-Addo’s assurances in December last year which was firmed up during the Stateo of the nation address that all monies will be paid.

Last year, President Akufo-Addo announced some GH¢15.6bn had been allocated to cater for the frustrated customers’ needs as pressure and threats heightened.

A letter addressed to the Minister of Finance, Mr Ken Ofori-Atta, by the President’s Executive Secretary Nana Asante Bediatuo, said, “The President has granted executive approval for an expenditure of up to fifteen billion six hundred million Ghana cedis (GH¢15,600,00,00.00) toward protecting depositors and investors of failed financial institutions and to improve liquidity of the financial sector”.

At the 2020 State of the Nation Address, President Akufo-Addo again confirmed before Parliament the monies have been released and stated payment was to begin on February 24, 2020.

However, four (4) months after the pledge, the disgruntled customers are yet to receive their funds in full. Others have reported a paltry 5% of their total deposits which is fast dwindling confidence in the Akufo-Addo government that is battling to fulfill half of its manifesto promises prior to the 2016 general elections that brought the NPP to power.

Hope Coming

But Mr Eric Opoku, who jabbed the government for its refusal to be honest with the citizens, noted that the next National Democratic Congress (NDC) under John Mahama will refund the depositors’ funds to them.

“Mr John Mahama will pay depositors, when elected,” he said and indicated that the NDC’s financial team has a fair appreciation on how to pay the suffering depositors. Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS