The Ghana government says it will deploy artificial intelligence (AI) to tackle trade related illicit financial flows.

The Ghana government says it will deploy artificial intelligence (AI) to tackle trade related illicit financial flows.

The country is losing billions of dollars to trade related illicit financial flows, according to the Minister of Finance.

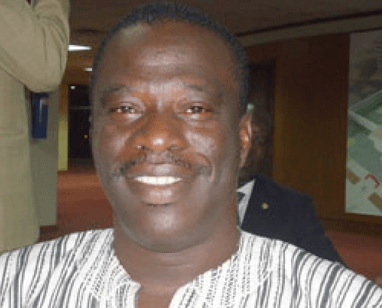

Presenting the 2026 budget to Parliament November 13, 2025, the Minister, Dr Cassiel Ato Forson said in 2024 alone, Ghana recorded imports valued at GH¢204 billion (Cost, Insurance, Freight), yet only GH¢85 billion was taxable, pointing to misclassification and under-invoicing.

He also said the Ministry has uncovered after an assessment of import transactions over five years that an amount of $31 billion was transferred out of the country for the importation of goods, but no goods were brought into the country after the transfers.

The Minister revealed that there has been an abuse of the Import Declaration Forms (IDFs) tool. He explained that the IDFs was a tool meant to support legitimate trade but now hijacked for illicit transfers and tax evasion.

He said the irregularities uncovered include: Importers transferring funds abroad in the name of importation with no goods brought in; Importers remitting more than the actual value of goods imported; and banks approving transfers above the $200,000 limit set by the Bank of Ghana without submitting supporting documentation.

“Between April 2020 and August 2025, over 525,000 transactions amounting to an equivalent of $83 billion were processed through the Integrated Customs Management System (ICUMS). Surprisingly, only 10,440 of these transactions were linked to actual imports. An equivalent of $31 billion in transactions were transferred abroad with no goods imported at all,” he said.

He further said in 2024 alone, Ghana recorded imports valued at GH¢204 billion (Cost, Insurance, Freight), yet only GH¢85 billion was taxable, pointing to misclassification and under-invoicing.

To tackle this, he said the government will deploy AI-driven pre- arrival inspections for all cross-border shipments.

“This technology will detect under-valuation, flag high-risk goods, and strengthen Customs’ capacity to combat smuggling, improve safety, and protect national security,” he said.

The Minister also noted that significant leakages at the ports continue to undermine revenue mobilization, citing a recent audit that revealed systemic weaknesses in classification, valuation, and cargo inspection.

“By integrating automation into port operations, we expect to significantly boost customs revenue, enhance trade efficiency, and close long-standing revenue gaps,” the Minister said.

Dr Forson also noted that Ghana continues to play a leadership role within the Africa Group in shaping the emerging United Nations Framework on International Tax Cooperation.

“Once adopted, this framework will empower countries like ours to effectively tax non-resident digital and multinational companies, curb illicit financial flows, and recover revenues lost through evasion and avoidance,” he said.

According to the Minister the move is a landmark opportunity to secure Ghana’s fair share of global income and strengthen the country’s capacity to finance national priorities without overburdening domestic taxpayers.

“Mr. Speaker, our revenue strategy for 2026 is bold, fair, and forward-looking. It rewards compliance, protects the vulnerable, and creates a tax system fit for a modern and inclusive Ghana. Through these reforms, we are not merely raising revenue, we are rebuilding trust between citizens and the State, ensuring that every cedi collected is used to build the Ghana We Want,” he said.

By Emmanuel K Dogbevi

The post Ghana government to deploy AI in tackling trade related illicit financial flows appeared first on Ghana Business News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS