![Economic recovery post-COVID-19: A case for Africa’s version of Bretton Woods system [Article]](http://ghheadlines.com/images/default.png)

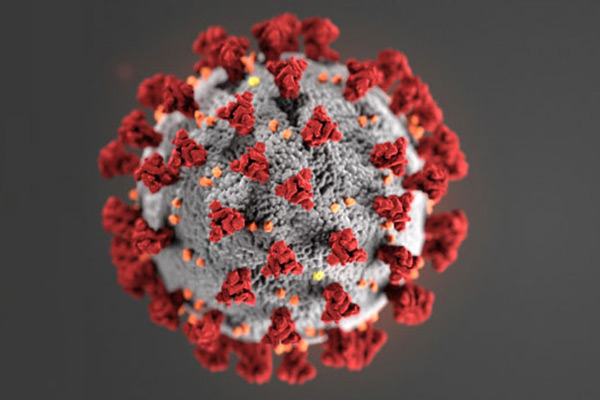

I am a concerned African youth. Worry would have been my word of choice, but it sounds depressing so let me just stick to concern. The dilemma of the economic consequence of a pandemic and the public health evidence necessary to decide on a lockdown or otherwise is a choice between the devil and the deep blue sea. I know, fellow Ghanaians, that being a president of any country in these times is about the most difficult job anybody can bargain for, especially, when your countrymen are like the people in the Exodus stories of the Bible.

I intend to reflect on this dilemma and as a follow up to my last article about the need to prioritize the African Continental Free Trade Area, make yet another suggestion (hopefully not to the wind) for an African agenda for economic liberation. I write today about long-term structural changes and monetary policy management changes that must enable African countries to be truly independent, empowering Africa to fully recover post-COVID-19.

The decision to lift the lockdown appears premature, at least, that is what the experts and evidence from a public health perspective show. But why will the decision become the only choice seemingly available for the leaders of the nation? The economic costs appear a much compelling cost to lives and livelihood such that risking human lives for economic enterprise is reasonable, so let us interrogate the economics a bit more.

The tradeoff between blood and money has always been real but during crises, blood money seems the only choice. The question is, what world economic system narrows the possibilities such that, usually blood money is the only choice left to countries like Ghana? The Finance Minister in his recent article, ‘What does an African finance minister do now?’ made a rather profound statement: “I am green with envy. To be honest, there is a lump in my throat as I think of Africa’s predicament. I question the unbalanced nature of the global architecture.”

The obvious question is, what is this global architecture and how unbalanced is it? The tales of the global economic order goes something like this; World War II is coming to an end. July 1944 is the date, the consensus is almost universal, political stability is only possible when there is economic liberty and creating a system of rules that enable international trade will bring wealth. United States of America was the obvious dominant nation, call it the beginning of US hegemony.

In the words of the famous economist John Keynes, “It has been our task to find a common measure, a common standard, a common rule acceptable to each and not irksome to any.” Note the time sequence however, at this time when the ‘developed’ world sought a mutually beneficial means to be more prosperous and an order not bothersome to any, Africa was still being colonized. It was therefore the colonizers building a global architecture whiles Africa was the colonies supplying raw materials for the economic survival of the powers that were. Let us be fair without reading race into the conversation, parties can only think about their interest and if you are not on the table or you happen to be incompetent on the table, it will be your responsibility and not the other party’s fault if you come up short at the end of the deal. Fair enough right? Well, not exactly.

The only problem is that, the ability to sit on the table as a worthy counterpart, even a forceful powerhouse seemed to have been robbed some hundred years before this July 1944 date. The Berlin Conference had taken place from November 1884 to February 1885. It was the official scramble for Africa which left us small, partitioned and without a sense as a union. The fathers of the United States of America had fought some twenty years before the Berlin Conference to preserve their union, a United States of America, and it was this Union of States in America that was setting the agenda for the new economic order in 1944.

Long story short, United States dollars became the reserve currency directly convertible to gold until Nixon’s shock in August 1971 made the paper dollar as good as gold. The International Monetary Fund (aka. IMF) and the International Bank for Reconstruction and Development (aka. World Bank Group) became the institutional vestiges to protect the reserve currency and the ongoing interest of its shareholders. America is of course the controlling shareholder, and yes other developed nations. Pax Americana had been born, a golden age of a prosperous dollar, and a trend of devaluation of developing countries’ currency because of deficits in trade balances, flow of capital and multinationals who speculate on currencies for quick profits not necessarily backed by economic activity.

The basic understanding was that, if a country produced more and exports its products and technology to other countries, that value of good or service will be measurable in USD and that ‘gain’ becomes a surplus in their current account. That gain for contributing to the world will be netted against all imports received. The net deficit balance of payment like a gap in a balance sheet must be financed. Because the currency of trade is the dollar, any countries gap has to be financed with the almighty dollar and it is only the United States who has the sovereignty to print the paper called dollar and dispatch it through these institutional vestiges.

A country that runs a deficit must finance that gap with the dollar loan from the Bretton Woods system or currently, China is the destination but they must pay back with tangible assets valued by a ‘Standard’ agreeable to the system and priced in agreement with the ‘forces of the market’. So fiat money which is nothing but paper printed by one country is sent to another and the other is required to payback with gold, oil, etc. in quantities deemed equivalent in amounts by this printing nation and payable by government taxes and revenue from the toils of its people, festering nothing more than the old age agenda of raw materials gained at the cheapest possible means. Worst off, a talented youth who sees the power of the dollar will value it and go hustle giving raw talent to the developed country widening the knowledge and technology gap with the developing world.

The argument usually then is to stop the deficit, produce and create a surplus and increase demand for your currency. The irony is that your currency does not provide liquidity for trade as much as the dollar will which means that in a floating rate regime as we have, free-market will mean I can convert my cedi to the dollar so that when I go to even China, the dollar is more acceptable rather than a cedi which may not be that acceptable. The bigger problem with trading with the reserve currency is that, the speculative enterprise becomes only one way; the true north will always be the direction of the reserve currency. Devaluation however has real consequences, falling disposable income for ordinary people.

Since deficits are financed in dollars and the home country’s currency is almost certain to devalue, the loan balloons and can rarely be repaid, resources then become available for cheap if not for free just by an exercise in printing cash. According to Professor of Economics and Public Policy at Harvard University, Kenneth Rogoff, “The world’s need for dollars has allowed the United States government as well as Americans to borrow at lower costs, giving the United States an advantage in excess of $100 billion per year.”

So let us bring the conversation home, there is a pandemic, lives are at stake, but there is a budget deficit that needs to be financed in dollars. No economic activity means no cedi to convert to dollars for trade which will lead to further depreciation of the cedi and increasing deficit then more borrowing in dollars for pandemic interventions and the cycle goes on, deepening the poverty. The government must intervene but must he do so by printing cash? Maybe but even that, the problem is, printing will require borrowing dollars since you do not print cedi in cedi, so someone will have to give Ghana paper in dollars to exchange for paper called cedi so we may pay with tangible assets in reserve.

Perhaps in the short term the conversation about debt forgiveness is right but in the long term we must sustain the conversation about why the dollar is the reserve currency and why African countries should not agree to invoice each other in a common tradable unit not the dollar or a currency pegged to Euro? Whatever the long term perspective may be, our eyes must be fixed on an African conversation that creates in the words of John Keynes a “common standard”, “common measure” and “common rules acceptable to each and not irksome to any.”

Let me conclude yet again in the words of Mr. Ken Ofori-Atta, “Where is the leadership and global task force that would mirror the 1944 Bretton Woods monetary conference?” I will only wish to modify that and ask, “Where is the African leadership willing and able to mobilize the global task force to create a new monetary system that does not impoverish Africa?”. By all means let us not forget the history that, after Bretton Woods, there was a Marshall plan where $12 billion foreign aid was given to Western Europe to develop because they were significantly affected by World War II. This journey to economic freedom is the real battle and it shall not be won except by knowledge and unity. So let us forget the petty partisanship and for once, let us focus on something truly extraordinary, building an economic system that does not perpetuate poverty for our people.

My name is Yaw Sompa, I believe for lack of knowledge the African will perish but through knowledge and superior discernment he shall be delivered and so I represent learning for the New African. I am an author of two books ‘Fate of System Thinking’ and ‘Be The Difference’.

The post Economic recovery post-COVID-19: A case for Africa’s version of Bretton Woods system [Article] appeared first on Citinewsroom - Comprehensive News in Ghana, Current Affairs, Business News , Headlines, Ghana Sports, Entertainment, Politics, Articles, Opinions, Viral Content.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS