Anti-Corruption campaigner, Sydney Casely Hayford, believes the Bank of Ghana (BoG) is interfering with the operations of Ghana’s newly launched mobile money interoperability platform because of the system’s links to e-zwich transactions.

E-zwich is an electronic payments channels developed by the Ghana Interbank Payment and Settlement Systems Limited (GHIPSS), which is a wholly owned subsidiary of the BoG.

GHIPSS is also the manager of the interoperability system, of which it has a stake in with the presence of E-Zwich being of the beneficiary of the improved networking for transactions.Already, GHIPSS has disclosed that it took a loan of $4.5 million from the BoG to implement the mobile money interoperability project.

But Mr Casely Hayford feels GHIPSS, and the BoG crossed the line when they introduced their product, e-zwich, onto the system while also serving as regulators.

“GHIPSS is controlled by the Bank of Ghana. How can you get the regulator to come in and introduce its own competitive product in the retail sector? How can you do that? The regulator can lend GHIPSS money because it is giving the money to provide the solution, but you cannot bring a competitive product onto the market to come and compete with all the other mobile products that are going out there,” he said on The Big Issue.

It cannot be owned by the regulator and then compete in the same space. The regulator is interfering, and it can’t do that,” Mr Casely Hayford added.

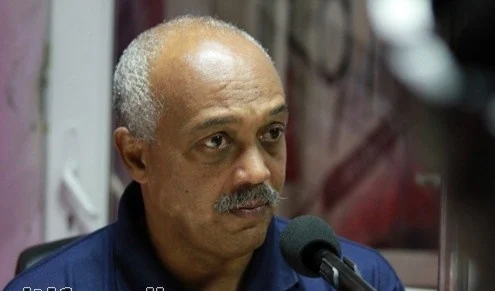

George Andah, Deputy Communications Minister

But in a retort, George Andah, a Deputy Communications Minister, insisted that e-zwich was a necessary component of the mobile money interoperability system.

“You have Ghanaians that have e-zwich [ards], and you need to give them the benefit of this interoperability… Most of the cocoa farmers are paid their earning from cocoa on e-zwich. The beneficiaries of LEAP [Livelihood Empowerment Against Poverty programme] are all being paid one-zwich.”

–

By: Delali Adogla-Bessa/citinewsroom.com/Ghana

The post BoG ‘interfering’ with mobile money interoperability system – Casely Hayford appeared first on Citi Newsroom.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS