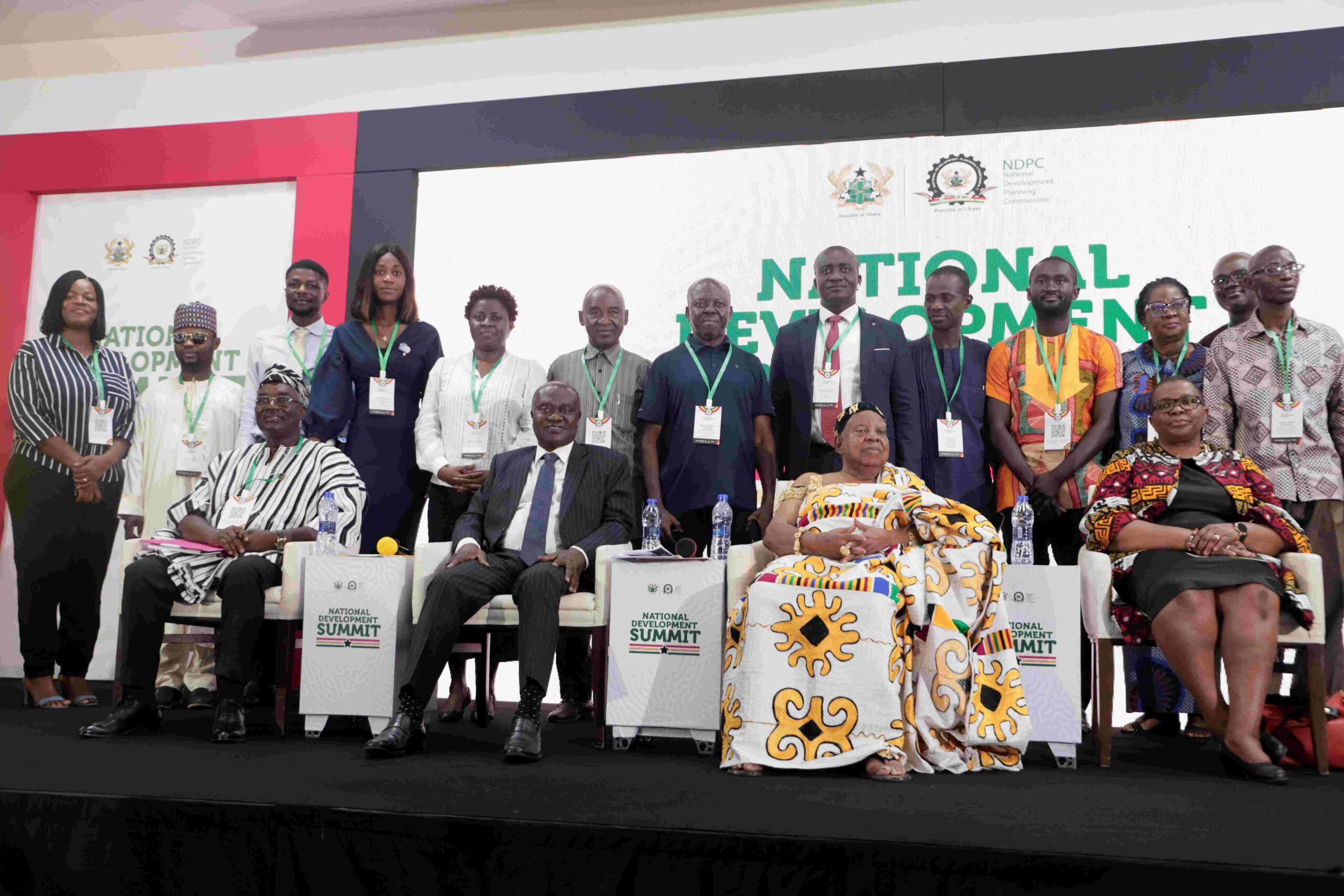

Economics panellists have delivered what could pass for a fine summary of the performance of Ghana's economy in 2017.

A year which started on a wavering note amid high debts, an unstable currency and uncertainty could be wrapping up in a positive manner.

In the January 2018 edition of the FocusEconomics Consensus Forecast - Sub-Saharan Africa, analysts write that "Economic activity gained ground in November as improving conditions in the domestic economy boosted demand."

They continued that "Exports of gold, cocoa and oil surged in the month, pulling the trade balance out of deficit. While the economy is undergoing a fast-paced recovery after falling commodity prices swerved growth off track last year, a heavy public debt burden threatens to disrupt long-term stability.

To help restructure the high debt load, Ghana, a nation described as "export-oriented" sold GHS 5.29 billion (USD 1.16 billion) in long-term bonds on 30 November. Aside from issuing a new five-year bond, the sale was largely comprised of a reopening of existing bonds.

Moreover, as part of the government's commitment to rebalancing the country's finances, multiple public sector reforms have been planned for next year. The reforms will seek to eliminate bureaucratic hurdles to efficient public service delivery, which should in turn better support the development of the private sector.

Following are more details of how FocusEconomics panellists analysed Ghana's situation.

What the future holds

A robust performance in exports and higher investment flows should buoy growth in 2018. The economy's elevated public debt burden and a high level of non-performing loans in the banking sector pose downside risks to the outlook, however.

Consequently, FocusEconomics panelists expect GDP growth of 6.8% in 2018, which is up from last month's forecast, and project it moderating to 6.0% in 2019.

Inflation inched up to 11.7% in November from 11.6% in October. The Central Bank reduced the monetary policy rate from 21.0% to 20.0% at its last meeting held on 27 November. FocusEconomics panelists see inflation averaging 10.5% in 2018 and 9.5% in 2019.

PMI climbs in November

The composite Purchasing Managers' Index (PMI), sponsored by Stanbic Bank and produced by IHS Markit, gained traction in November, rising to 54.8 points from 53.7 points in October. This marks 22 consecutive months that the index has been above the 50-point threshold that separates expansion from contraction in business activity. The monthly survey of business conditions in the Ghanaian private sector has been conducted since January 2014, but the findings were only publicly released from September 2017.

Ghana's private sector picked up in November amid strong economic conditions: Output and new orders accelerated from the previous month. New orders rose at a sharp rate, thanks to better economic conditions, improved product quality, customer recommendations and increased marketing activities. Backlogs of work rose for the first time in six months as new orders outpaced the climb in output, which was further exacerbated in some cases by a reported shortage of resources.

On the price front, a surge in input demand and weakening of the cedi against the U.S. dollar caused a sharp ascent in input prices. Staff costs also jumped, albeit at a slower rate than purchase prices. Increased price pressures prompted firms to raise output prices at a similar pace than in October.

FocusEconomics Consensus Forecast panelists expect fixed investment to expand 7.7% in 2018, which is up from last month's forecast. For 2019, panelists expect fixed investment to grow 7.0%.

FocusEconomics Consensus Forecast panelists expect the economy to expand 6.8% in 2018, which is up from last month's forecast, and 6.0% in 2019.

Inflation inches down in November

In November, consumer prices matched October's 0.9% month-on-month rise. November's increase was largely driven by higher prices for clothing and footwear, and food and non-alcoholic beverages. There was a jump in prices across all but the categories of education and hotels, cafes and restaurants categories, which registered a flat reading.

Inflation inched up to 11.7% in November from 11.6% in October. On the other hand, annual average inflation fell from 13.0% in October to 12.7% in November.

FocusEconomics Consensus Forecast panelists expect inflation to average 10.5% in 2018, which is down 0.1 percentage points from last month's forecast, and 9.5% in 2019.

Bank of Ghana kickstarts easing cycle as inflation trends down

Market analysts, who had expected the rate to be held steady, were taken by surprise when the Bank of Ghana (BOG) cut the monetary policy rate by 100 basis points to 20.0% at its 27 November monetary policy meeting. The Bank opted to reduce the rate as inflation continues to trend downwards amid strong economic growth.

Inflation dropped for the third consecutive month in October, to 11.6% (September: 12.2%). Core inflation, which excludes energy and utility prices, dipped closer to the year-end inflation target. Inflation expectations remain muted, which along with the trajectory of core inflation, signals that inflation remains on track to meet the medium-term inflation target of 8.0% plus or minus 2.0%. A boost in oil production, as producers seek to cash in on higher oil prices, pushed annual economic growth to 6.6% in Q1 and 9.0% in Q2. The latest survey data indicates that the strong growth momentum spilled over into Q3. Growth in the non-oil sector remains a concern, however, and measures to improve the sector's performance are underway.

The Bank's statement did not offer any substantive forward guidance, only stating that the future course of monetary policy, which aims to achieve the medium-term inflation target in 2018, remains contingent on continued economic growth, stability in oil prices and the foreign exchange market, and the government meeting its medium-term fiscal targets. FocusEconomics panelists also see inflation returning to within the Bank's target range by the end of next year.

FocusEconomics Consensus Forecast panelists expect the monetary policy rate to end 2018 at 16.57% and end 2019 at 14.50%.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS