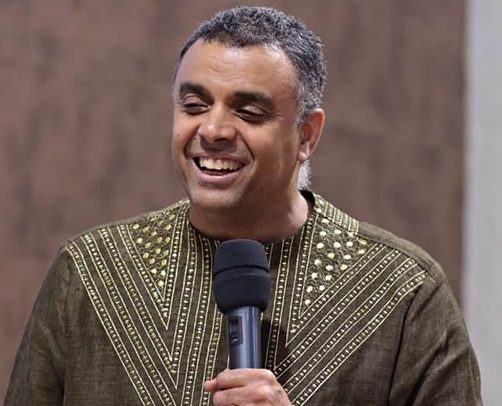

The 28% policy rate increase strengthens external buffers, supports the Cedi, and signals our commitment to macroeconomic stability at a time of heightened global uncertainty, the Governor of the Bank of Ghana, Dr Johnson Asiama has said.

However, he said they also recognize that the policy rate hike will affect borrowing costs for businesses and households.

While the policy tightening will affect funding costs and credit pricing in the near term, he said, the financial system is well-positioned to absorb these effects.

“We therefore urge banks to exercise prudence in adjusting lending rates and maintain transparent communication with clients. Viable businesses should continue to receive support, and tailored solutions should be explored to mitigate the impact on the most vulnerable sectors,” Dr Asiama said in a meeting with Chief Executive Officers (CEOs) of banks in Accra on Wednesday ,April 9

Dr Asiama further outlined how the banking sector is positioned to support recovery and resilience.

Overall, he said “we continue to witness broad-based improvement in financial stability, though we remain keenly aware that persistent challenges require our continued and focused efforts.”

He explained that the recent gains in macroeconomic stability following the DDEP, the improved profitability of banks amid the structural high liquidity and continuing recapitalization are improving the soundness in the banking sector.

Even without reliefs, he said, the Banking Sector Soundness Indicator (BSSI) showed sustained improvement on the back of improving solvency and asset quality measures amid strong liquidity and profitability.

“The banking sector continues to experience strong asset growth, expanding by 34.05 percent year-on-year at end-February 2025—funded primarily by deposits, which also grew by 27.89 percent,” Dr Asiama said.

He added that the industry remains solvent, recording a Capital Adequacy Ratio (CAR) of 14.35 percent, above the regulatory minimum of 10 percent, with most banks maintaining capital adequacy ratios above thresholds.

“Nonetheless, solvency concerns persist for a few domestically controlled and state-owned banks, where recapitalization efforts remain unclear. Addressing the capital shortfalls in these banks remains a priority.

“We are working closely with the affected institutions to achieve sustainable capital levels, restore depositor confidence and ensure compliance with regulatory requirements. Our supervisory engagement has intensified to assess the credibility of recapitalization strategies and to mitigate potential systemic implications.”

The post We recognize that the 28% policy rate hike will affect borrowing costs for businesses and households – Governor first appeared on 3News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS