Governor of the Bank of Ghana, Dr Johnson Asiama has said that the global economy was resilient through 2024, supported by strong real income growth and a less restrictive monetary policy stance relative to 2023.

In the first few months of 2025, he said, trade frictions arising from an emerging tariff war, elevated

global interest rates, and geopolitical tensions have heightened uncertainty about the global growth outlook.

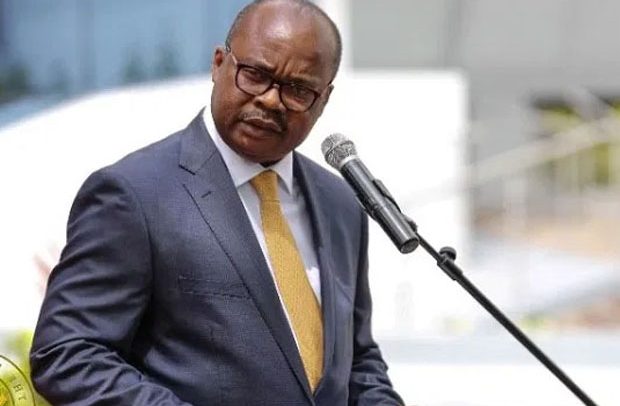

“These uncertainties have weighed negatively on consumer and business confidence, softened investor sentiment, and increased downside risks to growth,” Dr Asiama said during the 123rd Monetary Policy Committee (MPC) press conference held in Accra on Friday, March 28.

He added “The disinflation path has stalled in some Advanced Economies, on the back of persistence in services inflation, resurgence in goods inflation, and the recent tariff actions by the U.S. The imposition of additional tariffs by the U.S. and retaliatory responses have pushed up long-term inflation expectations in some Emerging Market Economies. In addition, the process of disinflation, which was

expected to be supported by a decline in crude oil prices, could be partly offset by the effect of the tariff increases. Against this backdrop, global inflation is expected to remain high in the near-term.”

Regarding the Policy Rate, the MPC, by a majority decision, decided to increase it from 27 per cent to 28.

Dr Asiama said that “While headline inflation has declined marginally, it remains a concern. Both food and non-food inflation are significantly above expectation, and core inflation remains elevated. While food inflation was driven largely by supply side factors, preventing second-round effects from such increases will be essential.

Read Also: Monetary Policy Committee of Bank of Ghana raises Policy Rate to 28%

“The persistent inflation dynamics over the past year, partly driven by both fiscal and monetary policy missteps, will require a policy reset to re-anchor the disinflation process. To restore price stability going forward will require a tight monetary policy stance, strong liquidity management, and commitment to the 2025 budget which seeks to reset the fiscal consolidation process.

“Under the circumstances, the Committee, by a majority decision, decided to raise the Monetary Policy Rate by 100 basis points to 28 percent to re-anchor the disinflation process. As inflation becomes firmly anchored, the Committee will reassess the scope for a gradual easing in the policy stance,” he said.

During the opening day of the sitting, Dr Asaiama said that while inflation is easing, it remains uncomfortably high, at over 23%.

He noted that progress has been slow, particularly on a month-on-month basis.

For instance, he said, structural drivers of food inflation remain persistent. He also stated that the external environment, though currently supportive, is becoming increasingly volatile.

“We’ve seen a strong trade surplus and solid reserve build-up on the back of gold exports and remittance flows. But a possible escalation in global tariff wars, rising geopolitical tensions, and weakening Chinese demand could quickly shift the dynamics. These global factors could also have spillover effects on inflation, capital flows, and exchange rate stability,” Dr Asiama said during the 123rd sitting of the MPC on Monday, March 24.

Domestically, Dr Asiama said, the 2024 fiscal outturn was expansionary, with the deficit exceeding program targets.

“We have seen encouraging signs of consolidation early in 2025, but questions remain as to whether current measures are adequate to anchor expectations and satisfy upcoming IMF program reviews.”

He also notes that financial conditions are evolving quickly. Liquidity in the system has increased, commercial banks have raised concerns about the Capital Requirements Regulations (CRR) framework, and “we must carefully assess its macrofinancial implications—especially with respect to inflation, foreign exchange demand, and credit growth.”

While private sector credit is recovering in nominal terms, real credit growth remains modest, he said.

“Banks are still cautious, and Non-Performing Loan (NPL) levels remain a concern. Meanwhile, our microfinance and rural banking sectors are showing early signs of stability, but recapitalization and regulatory reforms must continue to preserve confidence.

“We must also acknowledge that some of today’s challenges stem from earlier monetary and fiscal policy missteps—particularly loose fiscal policy during periods of macro stress, weak monetary fiscal coordination, and delays in key structural reforms. These contributed to elevated inflation, impaired policy transmission, and a loss of credibility. It is essential that we reflect on these issues—not to assign blame, but to strengthen our institutions and avoid repeating past mistakes.”

Dr Asiama also that there are also deeper, structural issues we must not lose sight of—such as underinvestment in agriculture, persistent exchange rate misalignments, and the need to deepen domestic financial markets.

These are outside the scope of today’s immediate rate decision, but they will shape the broader monetary policy landscape over the medium term, he said.

In short, he added “we are facing a convergence of risks: stubborn inflation, elevated liquidity, soft real interest rates, a fragile fiscal recovery, and growing external uncertainty. But we also have buffers—strong reserves, improving sentiment, and the credibility of our policy framework—to guide us.

“Our task over the next few days is to weigh these developments rigorously, and to reach a policy stance that reinforces the disinflation path without undermining the recovery or destabilizing market expectations. I trust that our discussions will be candid, evidence-based, and guided by our shared mandate of maintaining price stability and supporting sustainable growth.

The post Asiama: Geopolitical tensions have heightened uncertainty, weighed negatively on consumer & business confidence first appeared on 3News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS