The Director of Research at the Institute of Economic Affairs (IEA), Dr John Kwakye has said that ending the year with inflation of 23%, a Policy Rate of 27% and depreciation of 20%, represents a glaring failure of monetary policy.

To that end, he says monetary policy needs resetting.

To him, the time has come for the Bank of Ghana (BoG) to be made more accountable for delivering its inflation and exchange rate mandates.

The primary objective of the Bank of Ghana is to pursue sound monetary policies aimed at price stability and creating an enabling environment for sustainable economic growth.

Price stability in this context is defined as a medium-term inflation target of 8 percent with a symmetric band of ±2 per cent at which the economy is expected to grow at full potential without excessive inflation pressures.

Other tasks for the Bank of Ghana include promoting and maintaining a sound financial sector and payment systems through effective regulation and supervision. This is important for intermediation since risks associated with financial markets are taken into account in monetary policy formulation.

To achieve the objective of price stability, Bank of Ghana was granted operational independence to employ whichever policy tools were deemed appropriate to stabilise inflation around the medium-term target.

The Bank of Ghana’s framework for conducting monetary policy is Inflation Targeting (IT), in which the central bank uses the Monetary Policy Rate (MPR) as the primary policy tool to set the monetary policy stance and anchor inflation expectations in the economy.

In a post on his X page, Dr John Kwakye said that “Stabilising prices and the exchange rate is simple practical economics. It is not rocket science!”

He added “Closing the year with inflation of 23%, Policy Rate of 27% and depreciation of 20%, represents glaring failure of monetary policy, which needs resetting.”

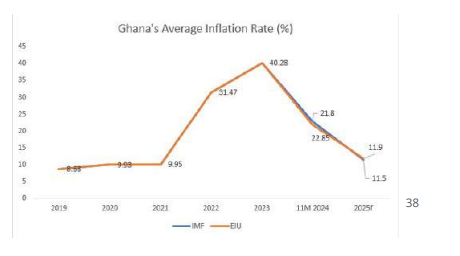

Meanwhile, Professional services firm, Deloitte is forecasting a further drop in inflation in 2025.

This, Deloitte said is due to a more stable cedi and falling domestic food prices. Delloitte projected inflation will average 11.9% next year.

“Ghana’s inflation declined in six of the 11 months so far in 2024, thanks partly to the effect of high interest rates. As of November 2024, the country’s inflation rate was 23%, a far cry from the government’s year-end target of 15%. Ghana’s 11-month of 2024 inflation average is 22.85%, down from 2023’s average of 40.28%”, Deloitte West Africa revealed in its “Sneak Preview of 2025”

It explained that the “declining trend is projected to continue 2025 at an average of 11.9%. This is still above the upper band of the Bank of Ghana’s 8% /-2% inflation target”.

It added that a more stable cedi, easing domestic food prices and waning supply side pressures will contribute to the projected decline in Ghana’s inflation rate.

The post Closing the year with inflation of 23%, Policy Rate of 27% represents failure of monetary policy – Kwakye first appeared on 3News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS