The Social Security and National Insurance Trust (SSNIT) has emphasized its unwavering commitment to ensuring the timely payment of pensions to its beneficiaries, stating that it has never missed pension payments since 1991.

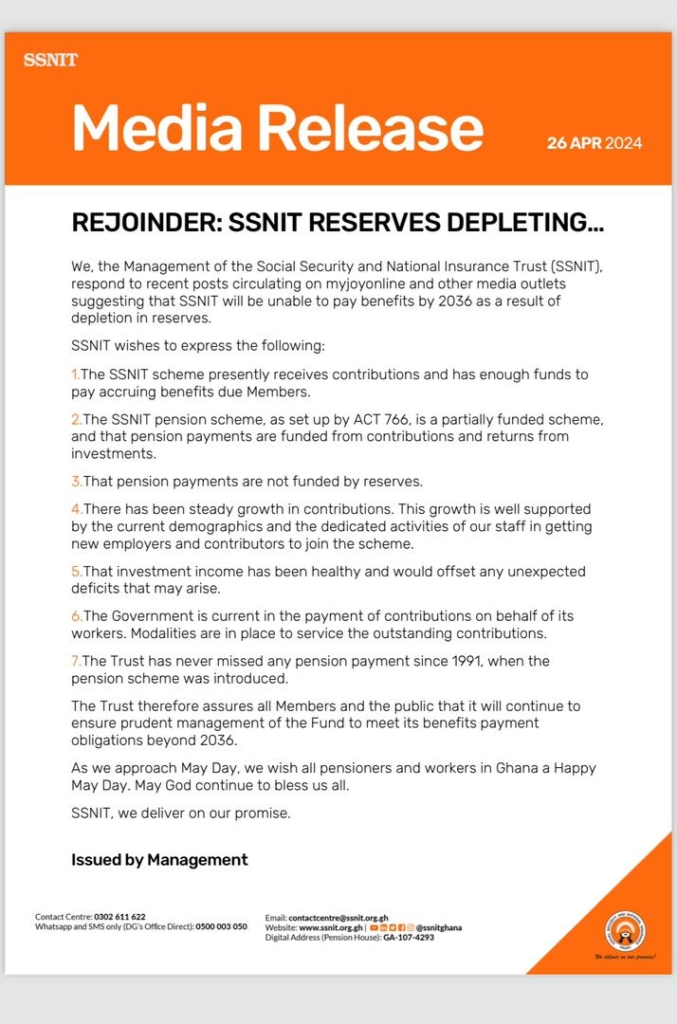

In a statement by SSNIT, has dismissed reports suggesting that it will be unable to pay benefits by 2036 due to depletion in reserves.

This comes as a response to concerns raised by some quarters regarding the consistency of pension payments.

SSNIT highlighted its track record of meeting its pension obligations without fail for over three decades. Since 1991, the organization has continuously disbursed pensions to retired workers, providing them with the financial support they need in their retirement years.

A recent report by the International Labour Organization (ILO) has raised concerns about the sustainability of the Social Security and National Insurance Trust (SSNIT), suggesting that its reserves may deplete by 2036, potentially jeopardizing its ability to fulfill financial commitments to beneficiaries in the future.

The report highlights a concerning trend where administrative expenses associated with managing pension funds have been steadily increasing as a percentage of member contributions to the scheme.

This trend raises questions about the allocation of resources and whether they are being used efficiently to serve the intended purpose of providing benefits to retirees.

However, SSNIT has responded to these concerns, asserting in a statement issued on Friday, April 26, that it currently receives contributions and possesses adequate funds to meet the accruing benefits owed to its members.

SSNIT clarified that the pension scheme, established by ACT 766, operates as a partially funded scheme, with pension payments funded from contributions and returns from investments, rather than reserves.

The Trust emphasized that there has been a steady growth in contributions, supported by current demographics and efforts by staff to enroll new employers and contributors.

Regarding investment income, SSNIT stated that it has been healthy and could offset any unexpected deficits that may arise.

Additionally, the government is reportedly up-to-date in paying contributions on behalf of its workers, with arrangements in place to address any outstanding contributions.

In summary, SSNIT aims to allay concerns about the future sustainability of the pension scheme by affirming its current financial strength, robust contribution growth, and prudent investment strategies despite challenges highlighted in the ILO report, SSNIT asserts its commitment to fulfilling its obligations to pensioners and ensuring the long-term viability of the pension scheme.

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS