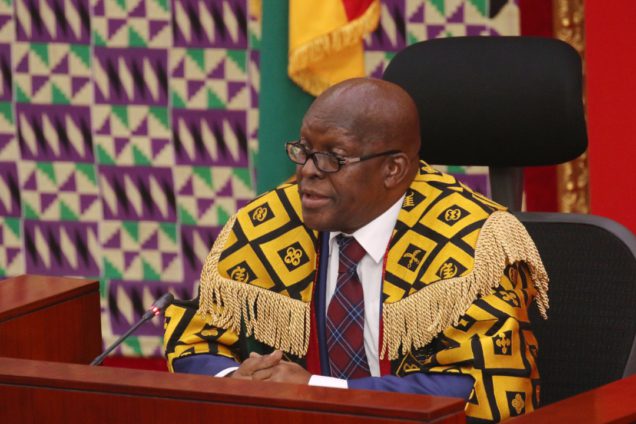

The Speaker of Parliament, Alban Bagbin, has said that the 2024 budget and financial statement is critical for the country.

He said Parliament will take its time in the final approval of the budget due to its importance.

Speaking at a post-budget workshop in Parliament, he underscored the importance of giving more attention to the budget.

“It is our duty to strive to improve upon the welfare of the people we serve. Even though we see this as business as usual for Parliament, this time around, it’s more critical than before. This budget is a critical budget, and I want us to take time because leadership has discussed it with me, and we have enough time for you to deliberate on the budget.

We are, therefore, expecting that you will not come and just make political statements or propaganda. Please listen to the voices of our people and do a critical analysis of the budget,” the Speaker of Parliament advised.

Relatedly, the Finance Minister announced that the government has allocated GHS4bn to address the challenges of the National Investment Bank and other banks.

He said as part of the Financial Sector Strengthening Strategy (FSSS), and mitigating the impact of the financial sector cleanup, the government has made allocations to recapitalize state-owned financial institutions as well as support indigenous banks.

Mr. Speaker, the Financial Sector Strengthening Strategy (FSSS), which was developed to mitigate the impact of the GoG debt operation on the financial sector, provides for the design of the Ghana Financial Stability Fund (GFSF) as a program in the Ministry of Finance. It also aims to address outstanding legacy issues following the 2017-2019 financial sector clean-up.

This Fund offers a solvency window consisting of two distinct sub-funds –namely a US$250 million World Bank supported sub-fund targeted at qualifying banks and SDIs; and a cedi equivalent of US$500 million GoG-funded sub-fund that will help to recapitalize state-owned financial institutions as well as potentially support other indigenously-controlled financial institutions to improve their post-DDEP solvency, he added.

He further disclosed that GH¢4 billion has been provided to address challenges facing the National Investment Bank and other distressed Specialised Deposit-Taking Institutions.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS