The government has been urged to consider taxing the profits made by social media platforms, from the country, as part of the new drive to mobilise revenues from local business activities taking place on such platforms.

The government has been urged to consider taxing the profits made by social media platforms, from the country, as part of the new drive to mobilise revenues from local business activities taking place on such platforms.

This follows the introduction of a 21 per cent Value Added Tax (VAT) on advertisements on the social media platform, Facebook.

The newly introduced charge, which takes effect from August 1, 2023, applies to both business and personal advertisements, according to Meta, the parent company of Facebook.

It is understood that going by this, all advertisers with a business country of Ghana will be levied, a 2.5 percent National Health Insurance Levy (NHIL), 2.5 percent GETFUND, one percent COVID-19 Levy plus the original 15 percent VAT.

Meta, in its communication on the development, said it is required to “charge VAT levies on sale of ads to advertisers, regardless of whether you’re buying ads for business or personal purposes,” an email from Meta Business noted.

“If you’re registered for VAT and provide your name, address and VAT ID, your name, address and VAT ID will show up on your ads receipts. In the event that you’re entitled to recover VAT, this may help you recover the VAT you paid to Ghana Revenue Authority if you are a VAT registered business in Ghana.”

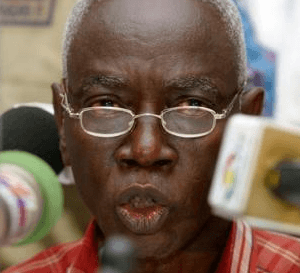

Commenting on the latest move which is deemed the government’s new approach in raking revenues from e-commerce and digital platforms, as part of its revenue mobilization agenda, the Senior Economic Analyst of NRGI, Dr. Alex Ampaabeng noted that there is more revenue potential to be explored from digital market players.

He said it was “very refreshing, getting to know that for the first time, Ghana is also going to benefit from digital market players. Over the years these companies have been benefiting, transacting right here in Ghana and we have been advocating for years.”

However, the Senior Economic Analyst of NRGI, who was speaking at the sidelines of a ‘Summer School on Effective Resource Governance,’ in Takoradi, observed that “the kind of tax we looking from the digitized companies should not end here. Because this one is more about the VAT.”

He explained that the new tax implies that the customers in Ghana are the ones paying for consuming the service, but then the profit of those institutions or organizations is still left untouched.

“They are making the right profit here, so if they were charging GH?100 for an advert, what they are doing now is that they are going to add all the VAT components for the VAT build-up and remit this to GRA, this is not enough,” he said.

Dr. Ampaabeng referenced the example of Kenya, which has slapped a three percent digital service charge as well as Nigeria which is also working on a six percent. So far, he said Kenya has proved that in less than seven months they generated over US$5 million.

It is against this background that he said, “We have that potential in Ghana to make more revenue, and it is very refreshing getting to know that GRA is doing something, but we want to tell them that VAT component alone is not enough and they should go a step further and taxing the gains those companies are making.

“We are not far away to propose a similar three or six percent on their gross profit from the monies they make here and GRA can easily do this by linking up with the National Communication Authority (NCA),” to make this happen, he said.

The ‘Extractives Industry Resource Governance Summer School 2023 was organized by the Accountability and Resource Governance of the Governance for Inclusive Development (GovID) under Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH.

The weeklong programme brought together stakeholders from the extractive sector, including the Ghana National Petroleum Corporation (GNPC), Ghana National Gas Company (GNGC), the Petroleum Commission, and the Ministry of Energy.

Others include the Public Interest and Accountability Committee (PIAC), Ghana Audit Service, think tanks, civil society groups, and media among others.

By Kizito Cudjoe

The post ‘Facebook tax’ must be extended to cover gains of Meta – Dr. Ampaabeng appeared first on Ghana Business News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS