The Bank of Ghana (BoG) has maintained the monetary policy rate at 30%.

This is the third time the Monetary Policy Committee (MPC) of the Central Bank has held the rate in a year, after doing the same in September 2023.

It also comes at a time when headline inflation has been witnessing some easing, hitting 35.2% in October 2023.

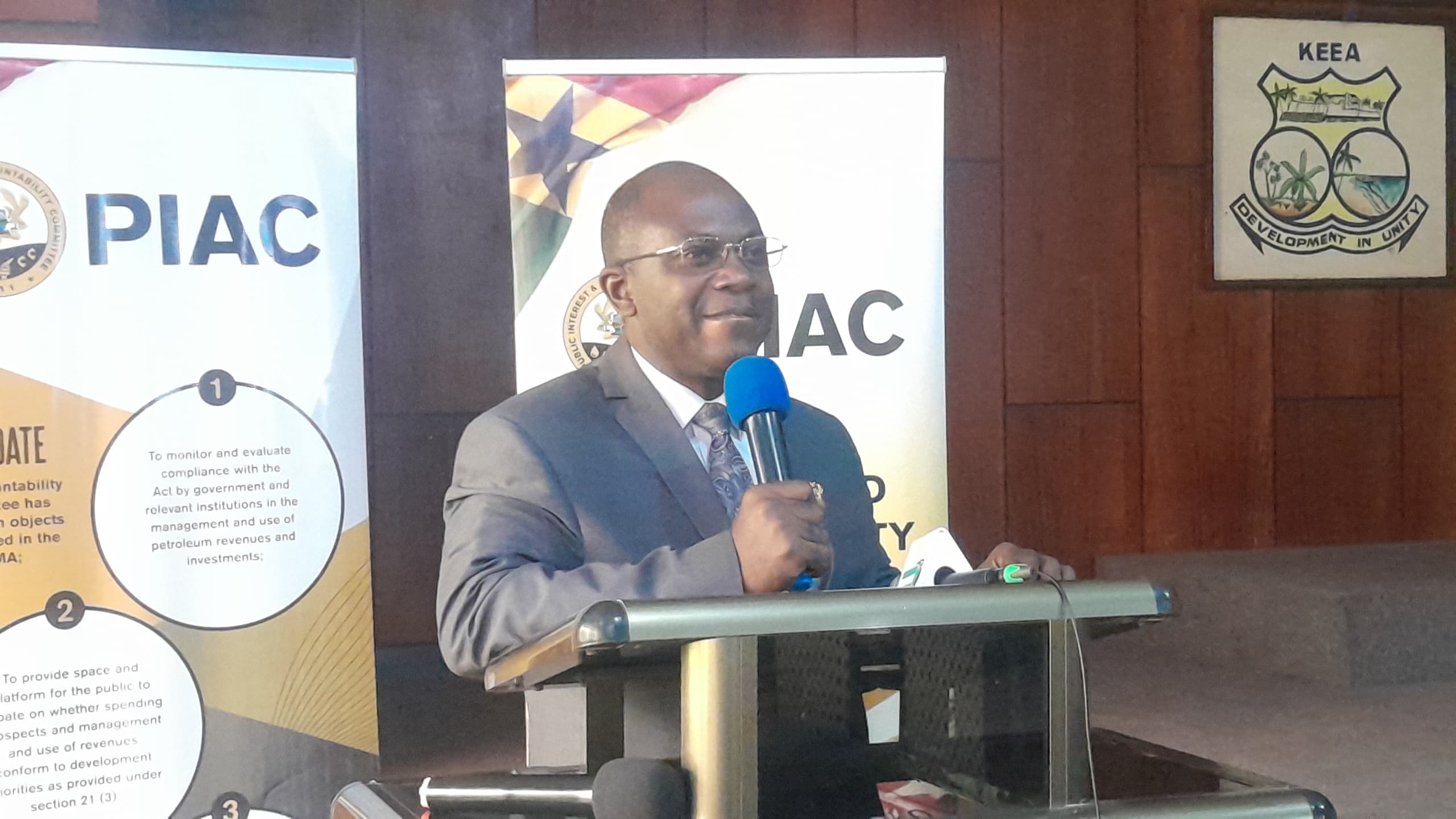

In his address to the media, Governor of the Central Bank, Dr. Ernest Addison, attributed the Bank’s stance to the need to strengthen the disinflation process, amongst other factors.

“In the outlook, sustained fiscal consolidation will be needed to place the economy firmly on the course of disinflation and economic growth. The implementation of the budget thus far has been strong, reflecting the attainment of fiscal targets under the program for the first review. The 2024 budget statement is also designed to reinforce the ongoing fiscal consolidation.”

Headline inflation has continued to decelerate in the past few months, consistent with forecasts. The latest Bank forecast indicates that the disinflation process is expected to continue, supported by the current tight monetary policy stance, a relatively stable exchange rate, and base drift effects. All the core measures of inflation and inflation expectations are pointing downwards, and the Bank will remain vigilant on risks to the disinflation process,” he said.

The Governor of the Central Bank stated that there was a need to keep the policy rate tighter for longer until inflation is firmly anchored on a downward trajectory.

“The Committee noted that although inflation is decelerating, it remains high relative to the target. Therefore, there is a need to keep the policy rate tighter for longer until inflation is firmly anchored on a downward trajectory towards the medium-term target. Given these considerations, the Committee decided to maintain the monetary policy rate at 30.0 percent.”

Click on the MPC statement by the BoG

The post BoG maintains monetary policy rate at 30% appeared first on Citinewsroom - Comprehensive News in Ghana.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS