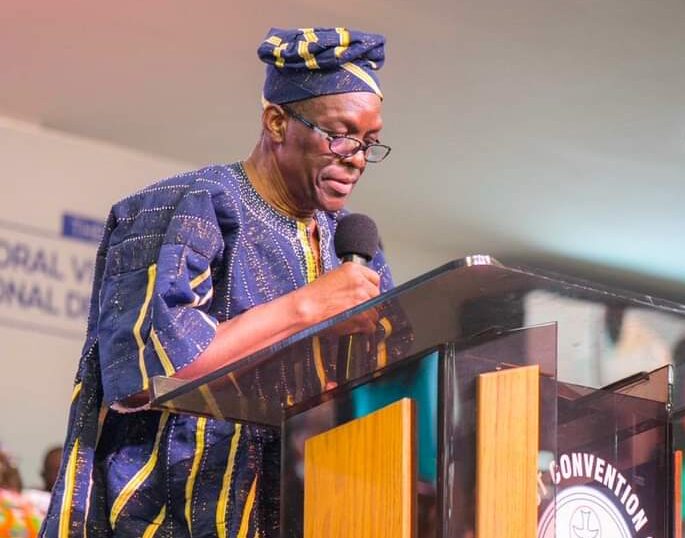

Director of Treasury and Debt Management Division at the Ministry of Finance, Samuel Arkhust, has stated that the ailing economy could have pushed the country into recession if the Debt Exchange Programme was not initiated.

According to him, the government couldn’t have watched aloof for the country to go into recession, which would have subjected Ghanaians to extreme hardships incomparable to what they are experiencing now.

The Government of Ghana launched the Domestic Debt Exchange Programme on December 5,

2022 with the aim of reducing the country’s domestic debt burden.

Per the programme, government is expected to go into a new arrangement with bondholders.

Mr. Arkhust added that the debt exchange programme was the only option for a quick turnaround from Ghana’s economic crisis.

Speaking on The Point of View on Citi TV, the Director of Treasury and Debt Management Division at the Ministry of Finance explained that, “how will the country be like if we had inflation of another 50%. What will be the value of your funding in your pocket? Can we stand that?”

“Can we survive that for two years? Won’t we be going into a recession? So the debt exchange programme is a carefully thought-through process, with something we have not done before, but something we have seen with others, and with experience at the back, this may be the only option to the crisis as quickly as sustainable as possible,”.

He said the debt sustainability was necessitated by a number of factors that had plunged the economy into crisis.

“The domestic primary balance has a direct link with debt accumulation. When it’s in surplus, debt reduces by the same measure. When it’s in deficit, debt increases by the same measure. Now the point is at 100% debt to GDP ratio. The primary balance you see there [2023 budget], you see the outlook is about 1% per year, so if I take ten years, that will be 10%. That means debt will come down from 100% to 90%, that is from the fiscal adjustment,”Mr. Arkhust explained.

According to him, the economic situation would have been disastrous if a debt treatment was not embarked on.

“The most important tool of government is to adjust. How do we get to the 55%? Will it be 30 years? With that, we needed to do something about the stock. And that is why we had to weigh the balance. If we do a debt treatment, that debt burden will reduce. What will be the flip side if we don’t do it? So it’s a balancing item, if we don’t do it, can the country survive another 50% depreciation next year? If you look at your money in two accumulative years that will sound like 100%,” Mr. Arkhust added.

The post Debt programme was carefully thought through – Ministry of Finance appeared first on Citinewsroom - Comprehensive News in Ghana.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS