By Kiki ROCKSON

In recent years, Ghana has witnessed a remarkable transformation in security, education, and financial services, largely driven by the adoption and integration of card technology. This evolution significantly shifts from traditional systems to more secure, efficient, and digital solutions. The history of card operations in Ghana reflects a broader narrative of technological advancement and adaptation, signaling a move towards a more integrated and digitally sophisticated society. While specific numbers are hard to come by, the widespread use of ID cards across universities and colleges for various services indicates a high penetration of card technology in the educational sector.

The introduction of card technology in Ghana can be traced back to the late 20th century, with the financial sector leading the way. Initial forays into card usage were primarily in banking, with the advent of ATM cards. These early days set the stage for a widespread acceptance of card technology across various sectors. In the educational sphere, universities began to explore ID cards not just for identification, but as multifunctional tools for access and payment. Similarly, the move towards digitized access control systems in the security sector marked the beginning of a new era in managing and monitoring entry to secured premises.

The dawn of card technology in Ghana marks a significant chapter in the country’s journey towards digital transformation and modernization. This evolution began with the banking sector’s adoption of card technology for financial transactions and has since expanded across various sectors, including national identification and access control systems.

The introduction of ATM cards in the late 20th century laid the groundwork for card technology in Ghana. Banks such as Ghana Commercial Bank, Ecobank, and Standard Chartered Bank led the way in offering customers ATM cards for easier access to their funds. This was a pivotal moment, marking the beginning of a gradual shift away from cash-based transactions towards more secure and convenient electronic banking solutions.

Following the banking sector’s lead, card technology soon found applications in other areas. Educational institutions began issuing ID cards that not only served as identification but also as tools for library access, payment for meals, and other campus services. Similarly, in the security sector, access control systems started to utilize card technology to manage entry into secured premises, enhancing security measures.

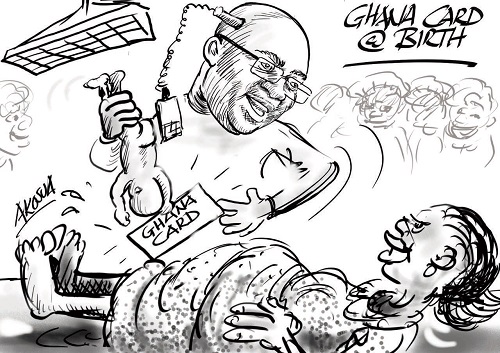

The national identification system represents one of the most significant applications of card technology in Ghana. The Ghana Card, introduced by the National Identification Authority (NIA), is a biometric card that includes personal information, fingerprints, and a photo. It serves multiple purposes, including voting, banking, healthcare access, and more, becoming a cornerstone of Ghana’s digital infrastructure.

Ghana has seen a steady increase in the adoption of banking cards. The Bank of Ghana’s reports indicate a growing trend in the use of debit and credit cards, driven by the expansion of ATM networks and POS terminals across the country. The exact number of active cards fluctuates, but the trend points to millions of cards in circulation, reflecting a growing preference for cashless transactions among Ghanaians.

There has also been a significant rise in the integration of mobile money with traditional banking, where cards are linked to mobile money accounts, facilitating a seamless transaction experience across platforms. This integration has contributed to the proliferation of card usage, particularly for online transactions and payments.

The National Identification Authority (NIA) has made considerable strides in issuing the Ghana Card to Ghanaians. By early 2023, over 15 million Ghana Cards had been issued, a figure that underscores the government’s push towards universal identification and digital inclusion. This card is pivotal for access to government services, banking, and even SIM card registration, making it a cornerstone of Ghana’s digital ecosystem.

While specific statistics on the usage of student ID cards, which often double as payment or access cards, are not readily available, it is evident that such cards are ubiquitous across Ghana’s tertiary institutions. They serve various purposes, from library access to cafeteria payments, indicating widespread adoption among the student population.

The future of card technology in Ghana looks promising, with ongoing efforts to expand its application in digital payment systems, public service access, and beyond. The continued growth in the usage of cards, coupled with advancements in technology, suggests that card technology will remain a pivotal component of Ghana’s digital landscape.

Ghana’s security sector has seen a significant overhaul with the introduction of smart card technologies. These advancements have enhanced the ability to control access to critical infrastructure and sensitive areas, ensuring that only authorized personnel can enter. The technology has been pivotal in mitigating risks associated with unauthorized access, thereby bolstering the overall security framework of institutions and facilities across the country.

In the realm of education, card operations have fundamentally changed how students interact with campus services and facilities. The multifunctionality of student ID cards—serving as library cards, access cards to dormitories, and payment cards—has streamlined operations and improved the student experience. This evolution began with simple identification purposes but has since expanded to encompass a wide range of functionalities, reflecting the growing needs and complexities of university life.

Ghana’s tertiary institutions, such as the University of Ghana, leverage card technology for a plethora of services, including library access, exam identification, and campus transportation, illustrating the card’s role in creating a cohesive educational ecosystem.

The financial landscape in Ghana has been dramatically transformed by the adoption of card operations. From the introduction of ATM cards to the widespread use of debit and credit cards, the sector has made significant strides in promoting financial inclusivity and simplifying transactions. This shift has not only facilitated easier access to banking services but has also encouraged a move away from cash-based transactions, promoting a culture of digital payments and financial literacy.

Banks and financial institutions have diversified the use of cards, introducing loyalty programs and integrating cards with mobile money platforms to offer a seamless transaction experience.

Integration with the banking sector allows for the use of the Ghana Card as proof of identity for opening bank accounts and other financial transactions.

The government mandated the use of the Ghana Card for the registration of SIM cards, aiming to curb fraud and enhance security.

The card is used to access various public services, including healthcare under the National Health Insurance Scheme (NHIS), and to streamline the process of obtaining passports and driver’s licenses.

The Electoral Commission of Ghana has integrated the Ghana Card into the electoral process, using it as a primary document for voter identification.

Electronic Merchant Services (EMS), a technology solutions company in Ghana, operates in a vibrant market characterized by growing digitalization and an increasing acceptance of card technology. To leverage the existing opportunities and navigate the challenges in the card technology landscape, EMS is employing a multifaceted strategy aimed at providing dazzling services to its customers and stakeholders. Here are a few of the approaches EMS takes:

EMS has developed and offers a broad range of innovative payment solutions that cater to different market segments, including retail, e-commerce, and mobile payments. This could involve contactless payments, QR codes, and NFC (Near Field Communication) technology, which complement traditional card transactions. The company provides solutions that integrate seamlessly with existing banking and mobile money platforms, allowing users to link their cards with mobile wallets for a unified transaction experience.

EMS has developed user interfaces that are intuitive and easy to navigate, ensuring that transaction processes are smooth, quick, and secure. A hassle-free experience can significantly enhance customer satisfaction and loyalty.

EMS utilizes data analytics to understand customer behavior and preferences, allowing for the customization of services. Personalized offers and solutions can meet specific customer needs, enhancing the overall service experience.

With the rise in digital transactions comes the increased risk of fraud and cyber-attacks. EMS prioritizes advanced security measures, including encryption, tokenization, and biometric verification, to protect customer data and build trust.

EMS ensures compliance with local and international security standards, such as PCI DSS (Payment Card Industry Data Security Standard), to safeguard transaction integrity and customer information. The company partners with banks, microfinance institutions, and mobile money operators to expand the card ecosystem. Such collaborations can facilitate wider acceptance of cards and digital payments across different sectors. Work closely with regulatory authorities like the Bank of Ghana and the National Communications Authority to stay ahead of regulatory changes and advocate for policies that support the growth of the digital payments ecosystem.

EMS has invested in the necessary infrastructure to support cards and digital payments, especially in underserved areas. This includes the deployment of POS terminals and the enhancement of internet connectivity to ensure reliable service availability. The company conducts educational campaigns to raise awareness about the benefits of digital payments and how to use them securely. Increasing digital literacy can drive adoption and encourage a shift from cash to digital transactions.

EMS uses data analytics to gain insights into market trends, customer preferences, and transaction patterns. These insights can inform the development of new products and services, as well as the optimization of existing offerings. The company innovates continuously, prioritizes security, and enhances the user experience. By addressing the challenges and harnessing the opportunities presented by the growing digital economy, EMS can position itself as a leader in the digital payments space, contributing to the financial inclusion and digital transformation of Ghana.

The journey of card operations in Ghana from its inception to its current state reflects a nation on the move toward digital excellence. The integration of card technology across sectors has not only enhanced operational efficiency but has also laid the groundwork for future innovations. As Ghana continues to navigate the path of technological advancement, the role of card operations in shaping the security, educational, and financial sectors will undoubtedly continue to grow, heralding a new era of digital integration and sophistication in the country’s developmental narrative.

In summary, the dawn of card technology in Ghana has set the stage for a digital revolution, transforming the financial, educational, and security sectors and paving the way for a more connected and efficient future.

The writer is the CEO of Electronic Merchant Services Ltd.

Disclaimer: All quotes, extracts, and excerpts are duly acknowledged.

Email: [email protected].

The post The evolution and impact of card operations: Transforming security, education, and finance with cards appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS