– Measuring ESG in the real estate environment in real time

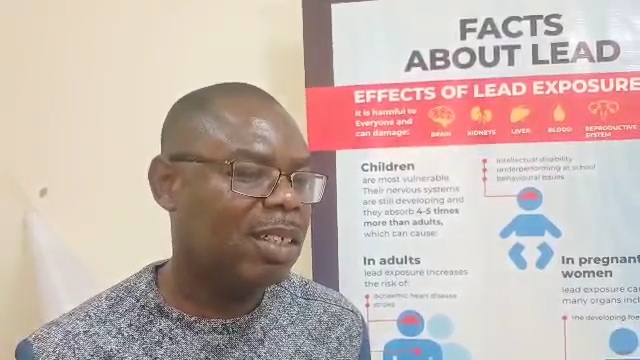

Greetings Ghana, so soon we are in the 3rd quarter! The year has been eventful and full of learnings. Today my good friend Songo S. Didiza, all the way from South Africa, makes a brief stop in Accra to guest present on an absolute relevant topic that we should be paying more attention. Songo is the Board Member, Independent Trustee and Sustainability Executive at Green Building Design Group. Before we deep dive into the topic Songo reviews the concept of ESG and then weaves it nicely into the larger real estate and prop-tech conversation within the South African context, from which we, in Ghana, can pick a leaf or two even from. Sit back and enrich your knowledge. Over to you Songo!

_______________________________________________

What is ESG reporting?

The sustainability reporting and disclosure processes have now been consolidated into the globally adopted ESG reporting framework. However, the principles behind ESG are decades, maybe even centuries, old (much older than my sustainability career even). It just depends on where you draw the line (or boundary scope as we often to refer it within the sustainability reporting context). A 2004 report from the United Nations – titled Who Cares Wins – carried what is widely considered the first mainstream mention of ‘ESG’ in the modern era.

ESG reporting is defined as “the process of publicly disclosing an organisation’s progress toward meeting its goals and commitments on environmental sustainability, social issues and corporate governance”. The reports are generally done on an annual basis and typically include details on different ESG metrics used to measure performance in those three areas in both quantitative and qualitative ways. They often also list the long-term objectives of ESG strategies and the reporting framework used to develop the report. Here are some examples of the globally adopted voluntary standard being used by companies today.

Real estate is the single largest contributor to climate change, being responsible for over 40% of global carbon emissions. In one of my work contributions towards Science Based Targets initiative‘s Advisory group it has been recently estimated that between 2020 and 2050 the global floor area will increase by 75%, meaning CO2 emissions would rise dramatically if no decarbonisation efforts are implemented immediately (STBI, 2023). Globally, the directors of public companies are increasingly facing climate-linked challenges from investors and other stakeholders to be proactive in managing ESG risks. According to PwC’s Emerging Trends in Real Estate 2022 report, 82% consider ESG when deciding on investments and operation initiatives.

The onset of ESG reporting requirements has created a need for a sustainability change management process within the real estate industry value chains (property management, developers, facilities management and property valuations as a whole).

Proptech Solutions for ESG Reporting

These growing investors concerns have led companies to explore technology solutions to implement and manage their ESG data, more certainly the “E” part of the ESG reporting process.Utilities are a significant component of real estate expense base and these costs, until recently, have been relatively uncontrolled. Landlords and Property Managers can now employ advanced dashboarding and record-keeping systems to report environmental performance to multiple stakeholders. Hardware proptech infrastructure such as smart meters, IOT devices and AI tools are being adopted by large commercial and retail estate clients.

Proptech has the potential to bring a range of efficiencies to the South African property sector. Benefits include increased automation, improved data analysis, and enhanced communication with tenants and investors. This can lead to better decision-making, reduced costs, increased building occupancy, and ultimately higher shareholder returns. ~ Joanne Solomon CEO, SA REIT Association

These technologies enable large real estate landlords take control of their utilities through increased accuracy and cost savings measures in real time. For instance, arranging a meter reading is a small job, but when you’re running a multiple portfolio real estate business it’s just one more thing to think about. With manual meter readings, a property manager would need to be around for an engineer/electrician, showing them the meter and waiting until they’re finished. A smart meter eliminates the need for any of this, meaning you can devote more time to seeing to the day-to-day property management activities and facility management services. Smart meters send real-time energy usage information automatically to the property owner without any need for a meter reading (see below).

Our integrated Smart Metering Solution offers digital innovation to the Commercial and Industrial clients through real-time monitoring of energy consumption for there entire complex facility (Green Building Design Group, 2023)

Smart Metering devices are essential building blocks for the creation of a greener and robust energy network due their ability to optimise the use of renewable energy sources within the real estate environment. These hardware devices enable real monitoring of a building’s overall electricity usage. The dashboard system (software) enable for increased visibility by the facilities’ team and asset managers; thus enabling for smarter integrated ESG reporting

Published by Songo S. Didiza, Board Member, Independent Trustee and Sustainability Executive at Green Building Design Group

The post REAL ESTATE MINUTE With Cyril Nii Ayitey Tetteh: ESG & REAL ESTATE appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS