Ghana has reached an agreement with its Official Creditors, paving way for a second tranche of $600 million from the International Monetary Fund (IMF).

Ghana has reached an agreement with its Official Creditors, paving way for a second tranche of $600 million from the International Monetary Fund (IMF).

The government’s agreement with Official Creditors under the G20 Common Framework on a comprehensive debt treatment beyond the Debt Service Suspension Initiative also opens the way for a $300 million World Bank support.

There will also be an additional $250 million from the World Bank for the Ghana Financial Stability Fund.

Announcing the development in a press statement on Friday evening, the Finance Ministry said the agreement “constitutes a significant positive step towards restoring Ghana’s long-term debt sustainability.”

“Today’s agreement with Official Creditors will support ongoing engagements with Ghana’s commercial creditors, including bondholders,” the statement noted.

The statement reiterated government’s commitment on also reaching an agreement with its commercial creditors as soon as possible.

It expressed appreciation to all stakeholders for the fete chalked.

The statement indicated government’s confidence of the $600 million in providing more financial resources in Ghana’s healthcare, education, and infrastructure development.

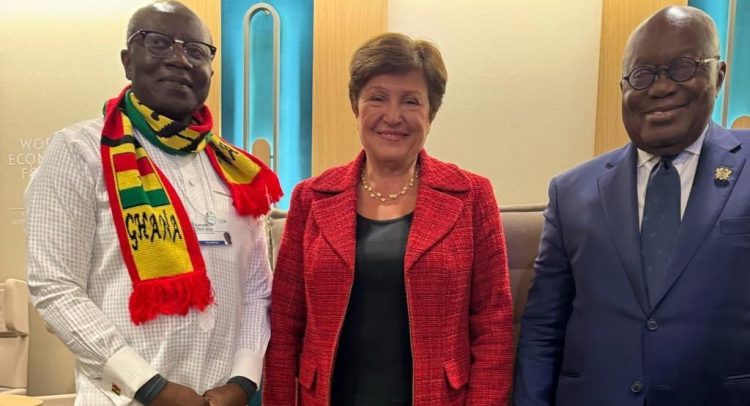

“This agreement clears the path for IMF Executive Board consideration of the first review of Ghana’s three-year Extended Credit Facility Arrangement in the next few days,” said, Ms Kristalina Georgieva, Managing Director, IMF.

“I look forward to continuing our fruitful collaboration with Ghana,” the IMF MD said in a statement on Friday.

Earlier, Ms Julie Kovack, Director, Communications Department, IMF, pledged that the IMF Staff Mission stood ready to “rapidly” present Ghana’s first programme review before the Board once agreement was reached between Ghanaian Authorities and Official Creditors.

She said that in response to a question by the Ghana News Agency during a press briefing on Thursday.

Source: GNA

The post Ghana gets Official Creditors green light to receive IMF $600m second tranche appeared first on Ghana Business News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS