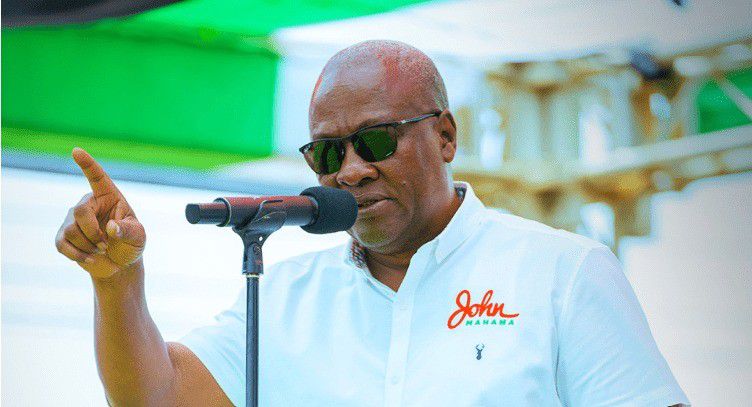

Dr Ernest Addison

The Monetary Policy Committee (MPC) of the Bank of Ghana has decided to maintain the policy rate at 27% in its latest review.

This decision was made after careful consideration of global economic conditions, domestic macroeconomic indicators, and the outlook for the economy.

*Global Economic Conditions*

In a statement, the MPC noted that global economic growth has remained robust, supported by the recovery of real incomes amid an ongoing process of disinflation.

The policy easing cycle initiated by major central banks in Advanced Economies (AEs) has generally supported growth.

However, potential challenges such as the lagged effects of past policy tightening, persistent geopolitical tensions, and a resurgence of trade protectionist policies present downside risks to the outlook.

*Domestic Macroeconomic Indicators*

The MPC observed that high-frequency indicators point to continued improvement in economic activity.

The updated real Composite Index of Economic Activity (CIEA) recorded an annual growth of 2.2% in September 2024, compared to a contraction of 0.4% in the corresponding period of 2023.

The banking sector remains sound, well-capitalized, and liquid, with total assets growing by 42.4% to GH¢367.2 billion at end-October 2024.

Solvency indicators also improved, with the capital adequacy ratio (with reliefs) increasing to 11.1% from 7.3% in October 2023.

*Inflation Outlook*

The MPC noted that inflation projections show a slightly elevated profile driven by high and unstable food prices, pass-through of previous exchange rate pressures, fuel prices, and utility tariff adjustments.

The price increases in food items have been steep in the course of the year, and together with a fast-paced depreciating currency earlier on in the year, have altered the inflation trajectory and stalled the disinflation process.

*Exchange Rate*

The MPC observed that the strong external sector performance is boosting confidence in the foreign exchange market, with the Ghana cedi recording appreciable gains.

Since end-October to November 2024, the Ghana cedi has recorded respective appreciations of 6.0%, 7.6%, and 9.1% against the US dollar, the British pound, and the euro.

*Conclusion*

The MPC decided to keep the policy rate unchanged at 27% in view of the current macroeconomic conditions and the outlook for the economy.

The Committee will continue to monitor global and domestic economic conditions and adjust the policy rate as necessary to ensure price stability and support economic growth.

The next Monetary Policy Committee (MPC) meeting is scheduled for January 21-24, 2025.

The meeting will conclude on Monday, January 27th, 2025, with the announcement of the policy decision.

-BY Daniel Bampoe

The post Monetary Policy Committee Maintains Policy Rate At 27% appeared first on DailyGuide Network.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS