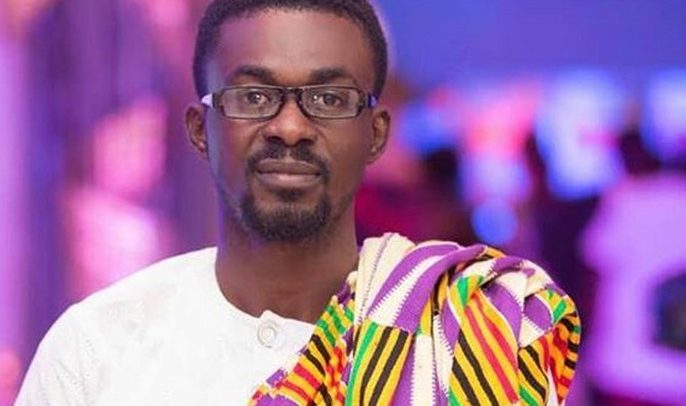

Nana Appiah Mensah aka NAM1

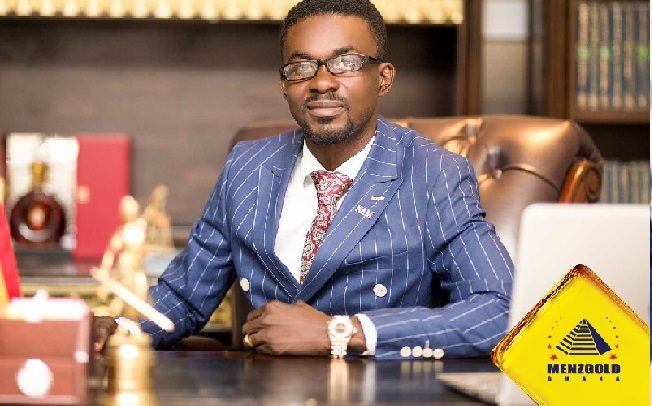

The trial of embattled Chief Executive Officer of defunct Menzgold Ghana Limited, Nana Appiah Mensah, popularly known as NAM1, and two of his companies has begun before a High Court in Accra with the prosecution calling its first witness as it pushes to establish the guilt of the three.

The witness, Stephen Attipoe, a Civil Engineer led in his evidence-in-chief detailed how he invested a total of GH¢5.2 million in the company’s gold vault market for 26 kilograms of gold.

He told the court that he also parted with a total of GH¢335,400 as a non-refundable 6.4% commission on the investments he made in the company, bringing the total amount he invested in Menzgold to GH¢5,535,400.

NAM1 and two of his companies – Menzgold Ghana Limited and Brew Marketing Consult Ghana Limited are facing 39 counts of defrauding by false pretence, inducing members of the public to invest and money laundering.

An initial charge sheet filed before the court accused the three of inducing members of the public to invest a total of GH¢1,680,920,000.

That figure has significantly dropped to GH¢340,835,650, which the three are said to have induced customers into investing due mainly to the fact that some of the complainants are not willing to testify.

Evidence

The prosecution’s first witness, Stephen Attipoe led in his evidence-in-chief by the Director of Public Prosecutions, Yvonne Atakora Obuobisa, told the court that out of the total money invested, he was paid a total of GH¢1,128,000 as his monthly 12% interest on the 26 kilograms of gold traded for the months of July and August 2018, on his behalf per the agreement he signed with the company.

However, in September 2018 when the company began facing payment challenges as a result of the restrictions placed on it by Securities and Exchange Commission (SEC), the witness said an Ecobank cheque with face value of GH¢240,000 given to him by Menzgold as his interest on only 10 kilograms was dishonoured when he went to the Tema main branch of the bank to cash it.

He said in November 2019, Menzgold customers were asked by management of the company to visit selected offices to validate their trading agreements.

“As a result of this directive, I went to the Madina office of Menzgold Company Limited on November 21, 2019, and submitted all the required documents. I was, therefore, duly validated by a lady named Amanda in the presence of Messrs Hortor (his Menzgold Client Relations Officer)”.

Mr. Attipoe, however, added that it has been five years since the company last paid him any money.

Cross-Examination

Kwame Akuffo, counsel for NAM1 and the two companies, in his cross-examination of the witness suggested that the witness took an investment risk and lost.

The witness disagreed and stated that he made the investments because the companies “represented themselves falsely to me,” adding that “after September 2018, I realised that the two companies were operating illegally due to the fact that they weren’t licensed by SEC.”

The lawyer also suggested that the SEC closed down Menzgold in September 2019, and this accounted for the company giving the witness a cheque for only GH¢240,000.

Mr. Attipoe agreed partly but indicated that the total amount that was due on that day was GH¢432,000 and not the GH¢240,000 which was paid by cheque which was dishonoured.

“Are you aware that the only time a default occurred in your relationship was when SEC intervened by closing down the business,” Mr. Akuffo asked.

“That is not correct, because he failed to pay me on September 1, 5 and 13. He failed even though the gold vault trading platform had not been shut down by SEC,” the witness added.

The case was adjourned to January 15, 2024, by the court presided over by Justice Ernest Owusu-Dapaa, a Court of Appeal judge sitting as an additional High Court judge.

BY Gibril Abdul Razak

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS