By Joshua Worlasi AMLANU

The economy is showing signs of recovery with both consumer and business confidence on the rise, according to latest surveys conducted by the Bank of Ghana.

The August 2024 reports reveal a marked improvement in sentiment across the board, fuelled by easing inflation, strong GDP growth and firms meeting short-term targets.

The uptick in confidence is largely attributed to ongoing improvements in the macroeconomic environment.

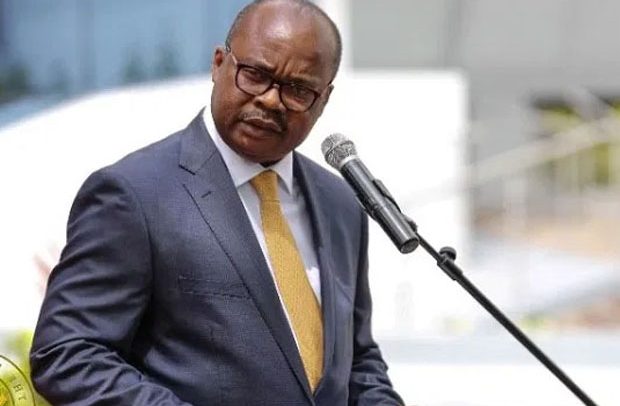

During a press briefing following the 120th Monetary Policy Committee (MPC) meeting, Dr. Ernest Addison, Bank of Ghana Governor, highlighted the key factors driving this renewed optimism.

“Consumer confidence improved on account of easing inflationary pressures, which has led to optimism about future economic conditions,” Dr. Addison noted.

He added that business confidence has also strengthened, as firms met their short-term targets and expressed positive sentiments about company prospects amid improving economic conditions.

This rise in confidence is particularly significant as it coincides with stronger than expected economic growth. Provisional data from the Ghana Statistical Service for second quarter-2024 showed real GDP growth of 6.9 percent, up from 2.5 percent for the same period in 2023.

The growth of non-oil GDP was even more impressive at 7 percent compared to 3.1 percent a year earlier.

The industry sector led this recovery with a 9.3 percent growth rate, rebounding from a contraction of 2.6 percent last year. The services and agricultural sectors also performed well, growing by 5.8 percent and 5.4 percent respectively.

This economic recovery is further supported by key indicators that point to sustained improvement in economic activity. The real Composite Index of Economic Activity (CIEA), a tool used by the central bank to track short-term economic trends, recorded an annual growth of 1.6 percent in July 2024.

This is a significant turnaround from a contraction of 2.8 percent observed in the same period of 2023. Key contributors to this positive trend included increased construction activity, rising household consumption and a boost in both exports and imports.

Dr. Addison emphasised that the improvement in macroeconomic conditions has been closely tied to the disinflation process, which remains on track.

Headline inflation has declined consistently, falling to 20.4 percent in August from 22.8 percent in June 2024. Food inflation, in particular, dropped to 19.1 percent in August from 24 percent in June, while non-food inflation decreased marginally to 21.5 percent.

“The disinflation process remains on track, supported by a tight monetary policy stance and easing food inflation,” Dr. Addison said.

He also noted that the Bank’s core inflation measure, which excludes volatile items like energy and utilities, eased to 19.4 percent for August from 22.1 percent in June.

This positive sentiment from both consumers and businesses is expected to drive further economic activity in the coming months.

The Purchasing Managers’ Index (PMI), which tracks the performance of the manufacturing and service sectors, also reflected this upward momentum – improving to 51.1 in August from 50.1 in July.

A PMI above 50 signals an expansion in business activity, reinforcing the view that the economy is on a path to sustained recovery.

The economy is projected to continue its upward trajectory, with the central bank optimistic that inflation will continue easing toward the target range of 13-17 percent by year-end.

The post Business, consumer confidence rebound appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS