While official inflation figures showed a welcome decline to 23.2 percent at the end of 2023, cost of living remains a major concern for Ghanaians – particularly for households struggling with stagnant wages and the sky-high prices of necessities.

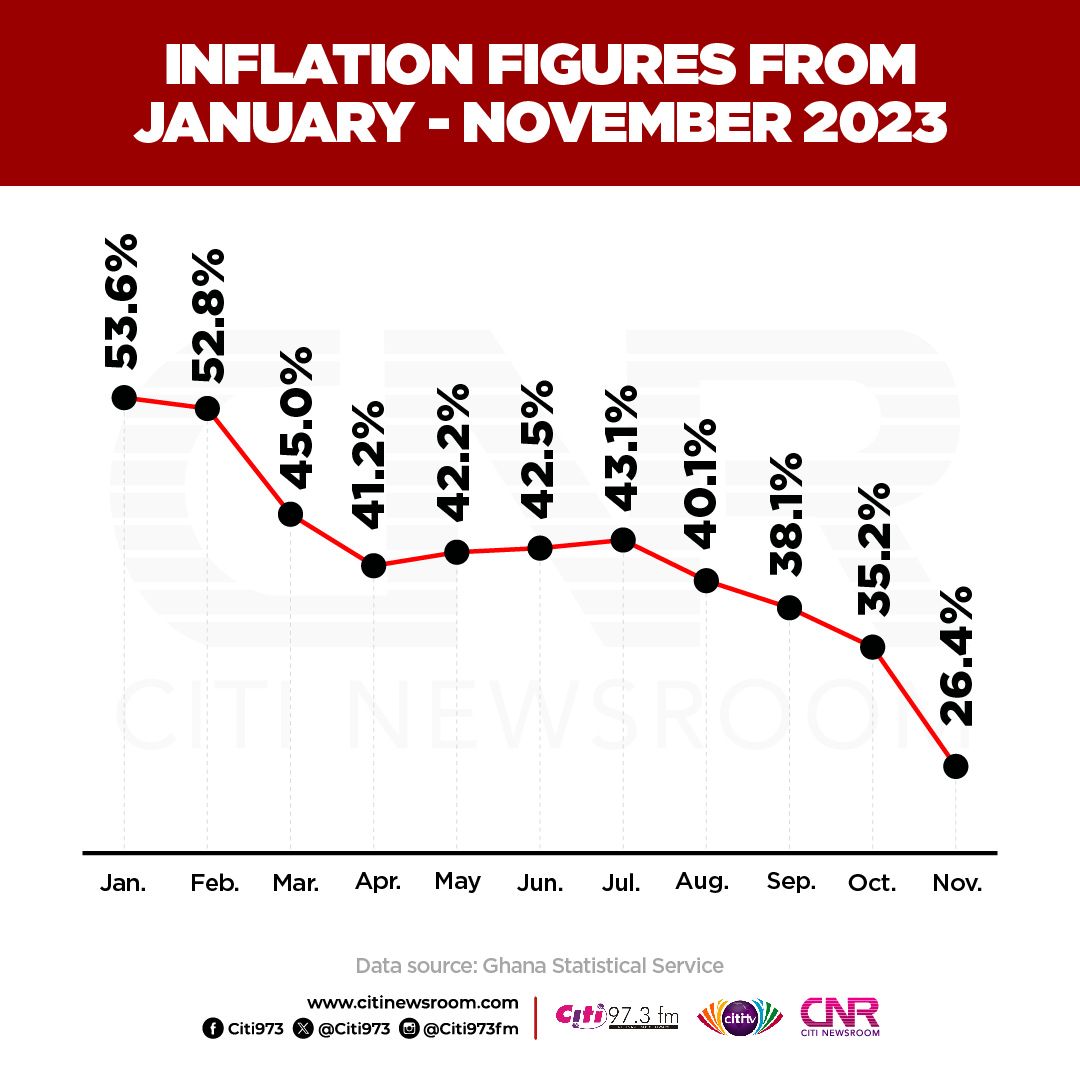

After more than a year of skyrocketing inflation, the nation witnessed a significant drop in 2023 – with last December’s rate falling from 54.1 percent during the comparable period of 2022 to 23.2 percent. However, this decline masks the persistent squeeze on workers’ purchasing power.

Currently, the impact of previous inflation rates is still evident – because if an item cost GH¢100 in December 2021, the same item would have sold for GH¢154.1 in December 2022 and GH¢189.55 in December 2023… highlighting the significant erosion of value over the last two years. Stated differently, one would require approximately 90 percent more to obtain the same goods and services at the beginning of 2024 than they would have required during the same period in 2022. Consequently, a salary of GH¢1,000 should, on average, have increased to GH¢1,900 to maintain its purchasing power.

Salary increases lag behind

While government implemented public sector salary increases of 30 percent in 2023 and 23-25 percent in 2024, it still falls short of the recent inflationary trend.

Although a 100 percent increase in allowances for beneficiaries of the Livelihood Empowerment Against Poverty (LEAP) programme in 2023 offered some relief, it was quickly negated by the skyrocketing food prices. These vulnerable groups face an even more challenging struggle to make ends meet now.

The Kenkey Index report published in September 2023 reveals a concerning trend. The weight of kenkey (at a given price) has shrunk by 32 percent year-on-year, while the price (at a given weight) has increased by 51.8 percent – aligning with Ghana Statistical Service’s national food inflation of 51.9 percent assessment at the close of 2023.

This represents a double-whammy for consumers – paying more for a significantly smaller product.

“Prices on the market now range from GH¢2 to GH¢5, but the most common price is GH¢4 – up from GH¢3 one year ago. Kenkey equivalent to the weight of a sachet of water now costs on average GH¢4.69; up from GH¢3.09 a year ago. The five-cedi kenkey entered the market around April, while the two-cedi kenkey is disappearing,” it read in part.

Bottom of the barrel

The private sector, however, has borne the brunt of this development. Some top firms in sectors like finance, and information and communications technology (ICT) appear to have provided some comfort for their staff. Two publicly listed tier-1 financial institutions saw staff salaries rise by 22 percent and 35 percent respectively in 2022. Similarly, a foremost technology company saw to an increase of 31 percent in workers’ pay.

However, many in the private sector have not seen adjustments since 2021. This stark disparity leaves them struggling to keep pace with the rising cost of living.

A logistics firm sales manager, speaking with the B&FT, summed up the frustration of many: “I have not seen a salary increase since the beginning of 2021; that is, three years ago as we were grappling with effects of the pandemic. I honestly do not know how I do it. I had heard of the proverbial magical management prowess of the Ghanaian worker growing up; now, I am living it”.

Similarly, a Human Resources Manager at a transportation company in Accra revealed the difficulties of keeping employees motivated amid salary delays and rising costs.

“It is tough keeping staff motivated when we are sometimes behind on salary payments and cannot honour other obligations. We have witnessed an uptick in staff trying to cut corners. As a result, we have maintained discipline but we are constantly looking for means to alleviate the burden for staff,” she remarked.

The post Falling inflation masking workers’ diminished purchasing power appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS